In the vast landscape of the industry’s thriving retail sector, a sparkling gem glistens with remarkable resilience – the independent jeweller. In a dynamic and ever-evolving industry, these passionate professionals continue to create waves, infusing creativity, craftsmanship, and a personal touch into their exquisite creations.

As we delve into the captivating world of independent jewellers, it becomes abundantly clear that this sector is not only surviving but flourishing. Despite the challenges of changing consumer preferences, shifting market dynamics, and the enduring impact of a global pandemic, these independent businesses have managed to carve a distinctive niche for themselves. Their unwavering commitment to excellence and the ability to adapt has solidified their position as formidable players in the jewellery industry.

Based on the insightful findings of our 2023 survey, the independent jewellers surveyed are predominantly owners or managers of their respective businesses, comprising an impressive 92 percent of respondents. This indicates a strong entrepreneurial spirit that permeates the industry, with these dedicated individuals taking charge and steering their enterprises toward success. With their staffing, 92 percent reported maintaining a workforce size ranging from one to ten employees. Additionally, eight percent of respondents boasted a slightly larger team size, employing between 11 and 20 individuals.

When examining the diverse landscape of store operations, 24 percent of respondents reported running their businesses from the comfort of their homes, exemplifying the entrepreneurial spirit and flexibility inherent in this sector. An additional 28 percent operate from studio spaces, and a further 20 percent of independent jewellers chose to establish their presence on bustling high streets, capitalising on the foot traffic and visibility offered by prime locations. Four percent opted for the allure of shopping centres, leveraging the convenience and exposure associated with these popular retail destinations. Intriguingly, 24 percent of respondents fell into the “other” category, highlighting the diverse approaches taken by some independent jewellers that defy traditional store classifications.

The enduring success of independent jewellers is apparent with a remarkable 56 percent of respondents proudly revealing that they have been operating for over 15+ years, firmly establishing themselves within the industry. As each year passes, these independent jewellers have honed their craft, refined their business strategies, and fostered enduring relationships with their loyal clientele. Their remarkable longevity is a testament to their dedication to thrive in an increasingly competitive market.

There is no shortage in the variety of products on offer in the independent jewellery space. 96 percent of respondents proudly delve into fine jewellery. In addition, 52 percent of independent jewellers demonstrate a keen focus on the allure of gemstones. In diamonds, 36 percent of respondents have embraced the emergence of lab-grown diamonds and 72 percent continue to sport natural diamonds. 48 percent of independent jewellers showcase their creativity with the versatility of silver. Recognising opals, 36 percent of respondents incorporate these gemstones into their designs. Pearls also find their place among the choice, with 56 percent incorporating these treasures into their collections. Lastly, 16 percent of respondents cater to the fashion-forward crowd, embracing the ever-evolving trends of unique pieces that captivate those seeking a statement-making style.

In addition to their remarkable product variety, independent jewellers demonstrate a keen understanding of their target markets, strategically focusing their attention on specific areas within the industry. 72 percent of these businesses prioritise bridal and engagement jewellery, 48 percent of independent jewellers direct their creative energies towards the ever-evolving world of fashion jewellery and six percent of independent jewellers primarily focus on men’s jewellery.

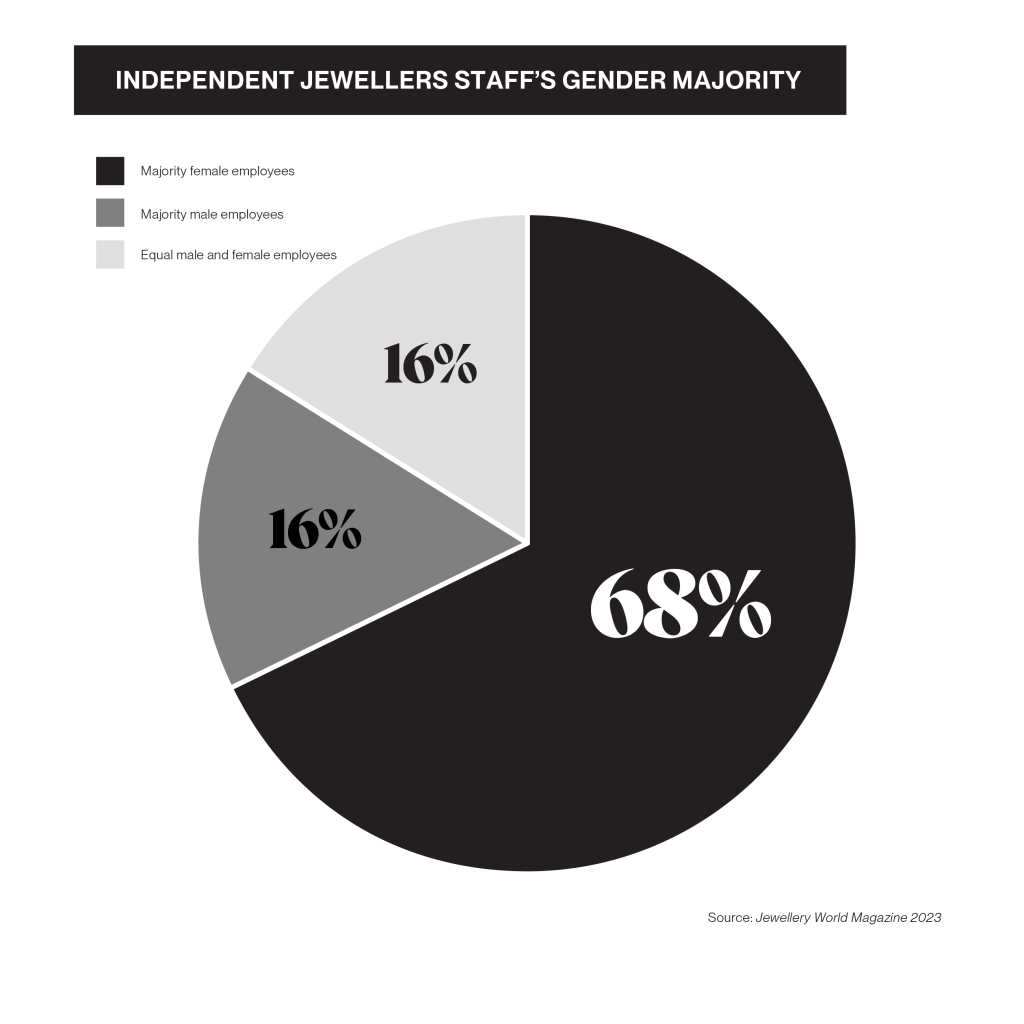

Independent jewellers are also committed to fostering diverse and inclusive work environments. Our survey reveals that 68 percent of respondents reported having a majority of female employees, highlighting the significant presence and contribution of women within the industry and 16 percent of respondents noted having a plurality of male employees. Additionally, another 16 percent of independent jewellers reported having an equal split between male and female employees, exemplifying their commitment to maintaining balanced representation within their teams.

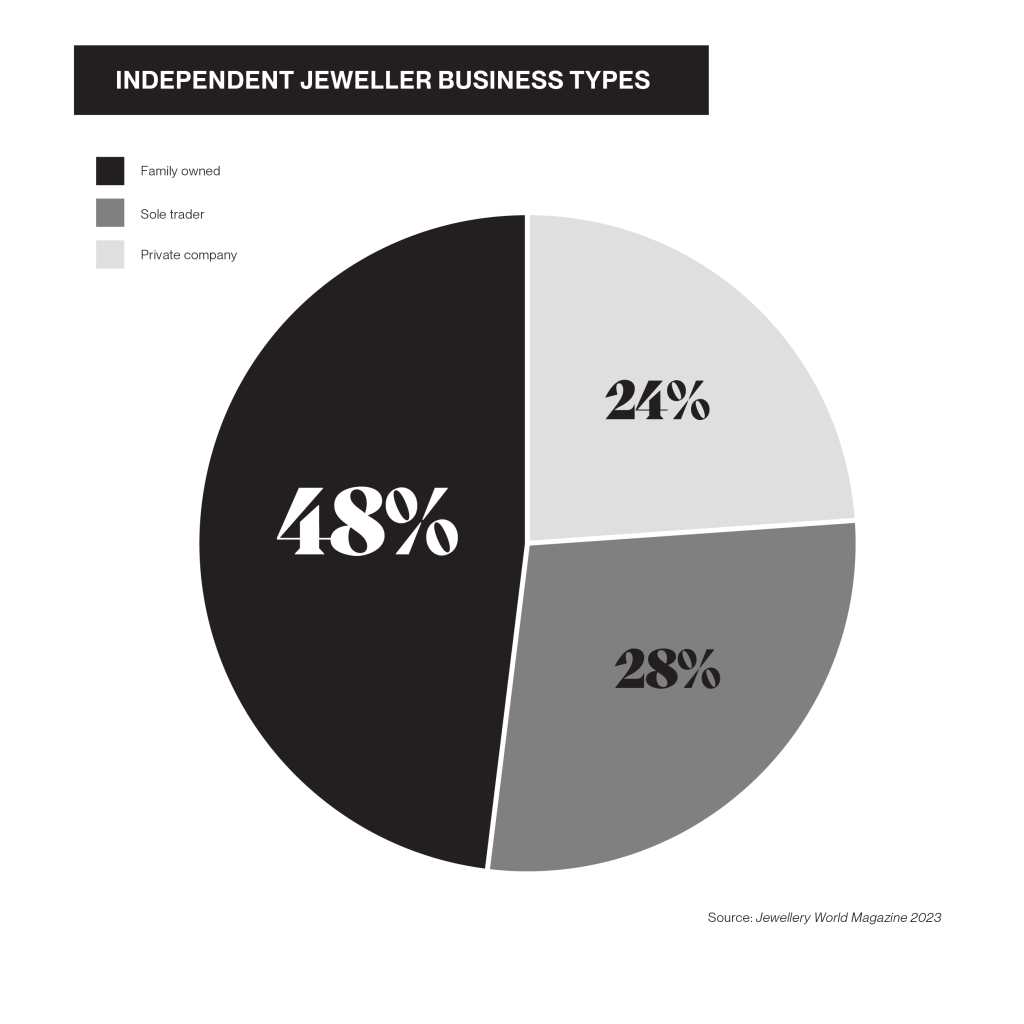

When examining the ownership structures of independent jewellers, our survey uncovers business models that contribute to the industry’s vibrant landscape. Of the surveyed respondents, 24 percent identified themselves as private companies, exemplifying the entrepreneurial spirit and aspirations for growth that drive these businesses. 28 percent of independent jewellers identified themselves as sole traders, showcasing the unique dedication and passion of individuals who single-handedly manage and operate their businesses. However, 48 percent of respondents proudly highlighted their businesses as family-owned, reflecting the deep-rooted traditions, heritage, and intergenerational knowledge that flourish within the industry. These family-owned establishments nurture a sense of legacy and continuity, passing down the artistry and business acumen from generation to generation. This enduring familial bond often resonates in their jewellery, infusing each creation with a rich history and a touch of sentimental value which consumers resonate with.

The transformative impact of the pandemic on independent jewellers cannot be understated. Despite the challenges it presented, our survey findings reveal a remarkable resilience within the industry. 88 percent of respondents noted a significant boost in employee productivity since the pandemic, with an increase of at least 50 percent. This impressive statistic speaks to the adaptability and resourcefulness of independent jewellers, who swiftly respond to the changing market dynamics and embrace innovative strategies to connect with their customers. Also, 40 percent of independent jewellers have recently witnessed remarkable expansion, with their businesses growing by at least 50 percent.

Regarding sourcing materials and building partnerships, independent jewellers demonstrate a strong inclination towards supporting local businesses. Our survey shows that an impressive 64 percent of respondents reported that most of their suppliers are local. This emphasis on local sourcing highlights the industry’s commitment to fostering local economies, promoting sustainability, and maintaining strong connections within their communities.

Despite the growing prevalence of online retail, the brick-and-mortar experience continues to play a significant role in the success of independent jewellers. 84 percent of respondents continue to witness a majority of their sales occurring in-store rather than online. By prioritising in-store sales, independent jewellers reinforce the value of building genuine connections, establishing trust, and providing exceptional customer service. This undoubtedly contributes to the long-term success and loyalty of their clientele.

Understanding their customer demographics is crucial for independent jewellers to tailor their offerings and provide personalised experiences. Our survey also reveals that 48 percent of respondents reported a majority of female customers. Additionally, 52 percent of respondents have an equal split of male and female customers, emphasising the inclusive nature of independent jewellers’ offerings.

The customer base of independent jewellers spans multiple demographics, reflecting the enduring appeal of their creations to a diverse range of age groups. 56 percent of respondents reported a median customer age of 30-40, indicating a strong connection with the millennial demographic. This highlights the significant influence of millennials, who value craftsmanship, individuality, and meaningful experiences when purchasing jewellery. 24 percent of respondents indicated a median customer age of 40-50, representing Generation X. 12 percent of respondents reported a median customer age of 20-30, the majority belonging to the Gen Z demographic. This tech-savvy and socially conscious generation seeks unique and socially responsible jewellery options, driving the demand for sustainable and ethically sourced pieces. Eight percent of respondents cater to customers aged 50 and above, representing closer to the Baby Boomer generation. By adapting their offerings and marketing strategies to resonate with different age groups, independent jewellers ensure their continued relevance and ability to connect with customers across generations.

When it comes to spreading the word about their businesses, independent jewellers employ a variety of marketing strategies to reach their target audiences. 92 percent of respondents rely on the power of word of mouth as a primary promotional tool, this highlights the significant impact of positive customer experiences. Independent jewellers also recognise the influence of social media, 60 percent of respondents utilise social media marketing to engage with their customers and showcase their jewellery collections. Additionally, 28 percent of independent jewellers use email marketing to reach their clientele. 16 percent of respondents allocate resources to online advertising, with a further eight percent still embracing traditional marketing methods. By combining these diverse marketing strategies, independent jewellers effectively navigate the dynamic landscape of promotion, ensuring their unique stories and exceptional craftsmanship reach the right audience at the right time, driving brand awareness, customer engagement, and ultimately, sales growth.

One of the key indicators of success for independent jewellers is customer retention, and our survey reveals that 76 percent of respondents have a significant number of return buyers, with over 50 percent of their customers coming back to make additional purchases. This high rate of customer loyalty highlights the importance of building strong relationships with customers by offering exceptional products, personalised services, and memorable experiences. Our survey findings indicate that a significant 84 percent of respondents offer supplementary services, with cleaning being the most frequent service provided. Jewellery requires regular maintenance and care to retain its brilliance, independent jewellers are actively ensuring that their customers’ cherished pieces remain in pristine condition.

Engagement rings still hold a special significance within the independent jeweller industry, and our survey reveals that they constitute a substantial portion of sales for a significant 40 percent of respondents, for these independent jewellers, engagement ring sales contribute to 50 percent or more of their overall sales.

Independent jewellers cater to a wide range of budgets, offering options that suit various financial preferences. Our survey reveals that 40 percent of respondents have an average sale falling between the $1000-$5000 range. 28 percent of respondents reported an average sale value between $5000-$10,000, highlighting a demand for higher-end and more luxurious pieces. 24 percent of respondents, their average sale falls within the $500-$1000 range, appealing to customers looking for elegant and affordable options. In addition, four percent of respondents reported an average sale value between $10,000-$20,000, catering to a niche market seeking exclusive, high-end jewellery pieces that make a statement and become cherished heirlooms.

Finally, 4 percent of respondents offer average sales below $500, capturing the attention of customers who appreciate affordable and versatile jewellery options. By accommodating a wide range of average sale values, independent jewellers ensure that there is something for everyone, regardless of budget. This inclusive approach allows them to serve a diverse customer base and establish themselves as trusted sources of exquisite jewellery at various price points.

Regarding the annual revenue generated by independent jewellers, our survey findings reveal a diverse range of financial performance. For 44 percent of respondents, their revenue falls under the $500,000 annual revenue bracket. Similarly, another 44 percent of respondents reported revenue between $500,000 and $2 million. These independent jewellers demonstrate steady growth and a solid customer base, carving a niche in the market and establishing their brands as reliable sources of quality jewellery.

On the other end of the spectrum, four percent of respondents indicated annual revenues exceeding $5 million. These thriving independent jewellers exemplify exceptional success, reflecting their ability to captivate a significant portion of the market and deliver highly sought-after jewellery pieces. An additional four percent of respondents reported annual revenues between $3 million and $5 million, showcasing a strong performance and a noteworthy position within the industry. Their sustained growth and profitability contribute to the overall strength of the independent jeweller sector. It is worth mentioning that four percent of respondents chose not to disclose their annual revenue figures.

In the competitive market, independent jewellers strive to differentiate themselves from their competitors through various means. According to our survey, a significant 84 percent of respondents agree that their customer experience is a key factor that sets them apart. By providing personalised attention, exceptional service, and a welcoming atmosphere, these independent jewellers create a memorable and enjoyable experience for their customers, fostering strong relationships and loyalty.

A further 80 percent of respondents highlight their product quality as a distinguishing factor. They prioritise craftsmanship and ensure meticulous attention to detail in every piece they offer. Industry expertise also plays a vital role, with 56 percent of respondents acknowledging its significance. This expertise instils confidence in customers, positioning these independent jewellers as trusted authorities within the industry. 52 percent of respondents emphasise their product variety as a competitive advantage. By curating a diverse range of jewellery options, they cater to a broader customer base, accommodating different tastes, styles, and occasions.

When maintaining brand loyalty and consumer trust, face-to-face interactions play a vital role for independent jewellers, as indicated by 96 percent of respondents in our survey. These personal, in-person connections allow independent jewellers to establish a genuine rapport with their customers, fostering a sense of familiarity, trust, and loyalty.

The independent jeweller industry is thriving, which is evident from the findings of our 2023 survey. This sheds light on the remarkable achievements and strengths of independent jewellers. From the impressive range of products to the emphasis on customer service and the ability to maintain brand loyalty, independent jewellers continue to make a significant impact in the market. Independent jewellers have successfully carved their niches, catering to various customer preferences and budgets. Their ability to stay attuned to market trends, provide outstanding craftsmanship, and offer personalised services sets them apart. The industry’s resilience, innovation, and customer-centric approach position it for continued growth and success in the years to come.

Further reading: