It’s no secret that jewellery is a hot commodity in Australia. From sparkling diamond rings to eye-catching necklaces, the range of products available for purchase continues to evolve with consumers. Understanding current trends in the market can give retailers, suppliers, and manufacturers an edge over their competitors. As competition rises from both bricks and mortar stores and online retailers, staying updated on what drives customer purchase habits is key for success in today’s competitive market.

The jewellery industry is in a period of rapid change as the market of both fine and fashion jewellery shifts with its consumer . Online only retailers are dramatically shaping consumer preferences, resulting in an overall drop in demand from traditional sources. Despite increasing competition, many retailers can and have capitalised on unique opportunities in niche markets such as ethical jewellery, gender neutral options and other emerging trends.

So, what is the Australian consumer telling us? Let’s dive into the facts.

The jewellery industry is heavily influenced by many variables. Everything from socio-economic trends to fluctuations in the market can impact its success, making it one of the most complex and dynamic industries. Consumer sentiment remains a powerful influence on the jewellery industry. This generally affects market trends and movements. When consumer sentiment is positive, they are more likely to invest in more expensive jewellery. However, when consumer sentiment is down, households adjust their expenditure on goods and services which can affect the overall performance of the jewellery industry.

Consumer sentiment is projected to decline in 2023, with a forecasted 6.2 point decrease predicted in both the Fashion Retailing in Australia Report and the Fine Jewellery and Watch Retailing Report by IBISWorld. This will result in a slight reduction in expenditure from consumers in the industry. Real household discretionary income reveals how much consumers are able to spend on jewellery. When incomes grow, households have more purchasing power and tend to gravitate toward more expensive options, creating a valuable opportunity for industry growth. Unfortunately, the opposite is true for when incomes decrease. The data collated by IBISWorld suggests that real household discretionary income is set to fall by 4 percent in 2023.

However, it is not all bad news in the world of spending. Online retailing is blooming as consumers embrace the convenience of purchasing items from the comfort of their homes. This trend is showing no signs of slowing down over the next 12 months. As the digital shopping experience increases in popularity, savvy shoppers have more choices than ever before when it comes to both fashion and fine jewellery. Traditional bricks and mortar retailers without an online presence have faced an uphill battle in competing against the low prices found on online stores, putting many of these businesses at risk. IBISWorld forecast the demand for online shopping to rise by 6.6 percent in 2023 – meaning those not willing to adopt digital practices will be left behind.

Industries at a Glance

Fine Jewellery

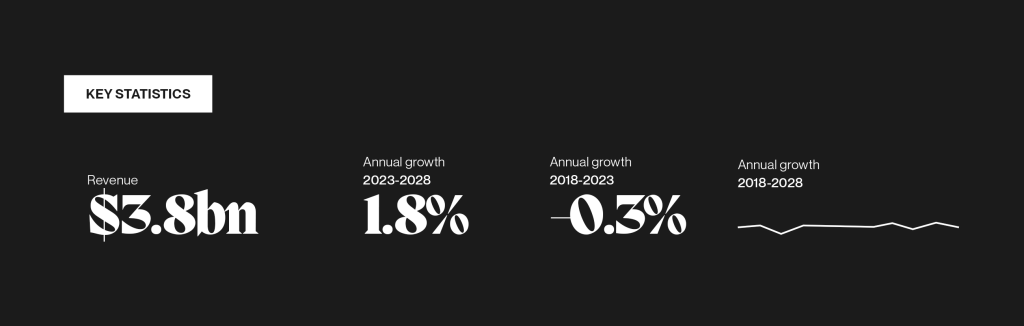

The current state of the fine jewellery and watch market is also being impacted by an impending dip in both consumer sentiment and real household discretionary income. However, also on a positive note, annual growth from 2023 onwards is set to increase fine jewellery revenue by 1.8 percent.

Fashion Jewellery

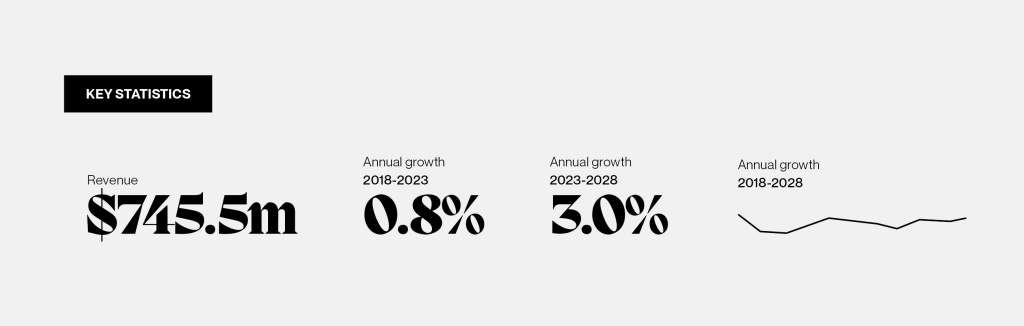

Showing a positive outlook in the annual growth of fashion jewellery options, the Australian Market of fashion jewellery is expected to improve from this year onward in terms of annual growth by 2.2 percent. This projected margin will increase revenue for fashion jewellery by more than $22M.

Products and Market

Fine Jewellery

The fine jewellery industry is a vibrant and dynamic sector, driven by an expansive range of products that cater to diverse markets. In order to thrive, companies must stay on top of trends and continually adjust their strategies. As fewer couples say “I do”, the decline in demand for engagement rings and wedding bands hurts precious stones jewellery sales. The affected marriage rates in Australia can be explained by the pandemic, which essentially brought everyone’s lives to a standstill. Despite this, the younger generations are leaning towards less traditional jewellery practices. By integrating these modern trends into their jewellery, businesses can optimise sales and cater to more demographics.

The current market for fine jewellery is proving to be prosperous for small and independent jewellery stores that provide additional services. Specialist retailers benefit significantly from the post-purchase needs of their customers, as they strive to maintain the quality and longevity of high-end jewellery and watches. To truly stand out in the crowded marketplace, discovering and honing in on your business’ niche can be a game changer. Identifying what makes you unique will allow customers to quickly recognise why your product or service is superior.

The global pandemic has proven to be a major depressant on the fine jewellery industry. With virtual gatherings and loungewear taking over, demand for fine jewellery saw a significant decline. As life returned to normal, so did the need for more formal fashion and jewellery. However, silver and gold prices are forecasted to decline in 2023. Fluctuations in the cost of precious metals, like silver and gold, can drastically affect industry pricing.

Fashion Jewellery

In the fashion jewellery market, earrings are the must-have accessory of the season, with their popularity increasing as a result of emerging fashion trends. Fashion earrings come in a wide variety of styles and materials and the rising popularity of minimalistic gold earrings and statement earring pieces like large hoops and pearl earrings has backed the demand.

Ring sales have been impacted by the introduction of more resilient alternatives. Stainless steel and brass rings have typically been sought after fashion jewellery pieces. However, their tendency to start tarnishing over time has caused a shift towards fine jewellery as consumers look for more dependable options. The consumer demand for high-quality gold and silver chains has also had a profound impact on fashion necklaces, demonstrating a shift in consumer preference towards items of lasting value.

With attempts to steer away from fast-fashion, changing consumer spending patterns among younger generations have led to more shoppers investing in quality, long-lasting chains. Popularised by celebrities and influencers, stylish gold and silver chains continue to remain at the forefront of fashion trends.

Demographics

Fine Jewellery

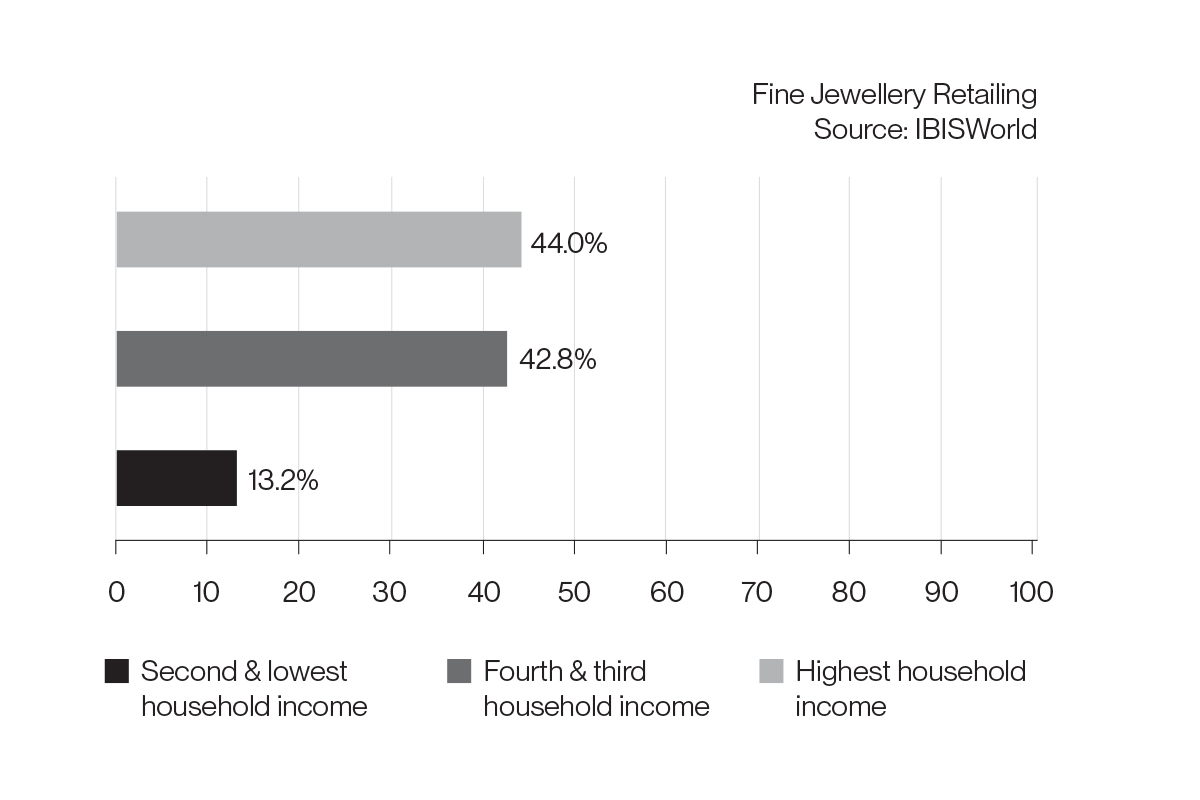

As we are aware, consumer sentiment and discretionary income are influencing the jewellery industry which impacts how and when people make their purchases. The purchase of fine jewellery is closely linked to household economic stability, as evidenced by demographic data. Utilising quantiles helps break this relationship into three distinct demographics for further exploration.

The highest income quantile has a major market segmentation totalling to 44 percent of all fine jewellery purchases. With many fine pieces being priced in the thousands, they often require substantial shares of a household’s discretionary income and are generally only available to those who earn high wages. This fraction of high income earners tends to stay shielded from negative consumer sentiment due to those with higher incomes usually having financial security and overall stability to make these purchases.

Surprisingly not far from the highest income quantile, fourth and third household income quantiles, containing middle-wealth households, major market segmentation totals to 42.8 percent of fine jewellery purchases. Shopping for metal jewellery items is an increasingly popular trend amongst this demographic, as they tend to be more affordable than pieces set with precious stones or luxury watches. Discretionary household income can have a significant influence on whether this demographic chooses to purchase fine jewellery, however, they still make up a major part of the market and should not be overlooked.

Although not as surprising, households in the two lowest income quantiles make up a smaller portion of revenue for the fine jewellery industry with their major market segmentation only contributing 13.2 percent. Although some households from lower income brackets allocate a portion of their budget to purchasing jewellery, the frequency and range of items purchased is likely far less than that seen in higher earning quantiles. However, despite their economic circumstances, purchasing engagement rings remains a constant consumer demand in this demographic.

Fashion Jewellery

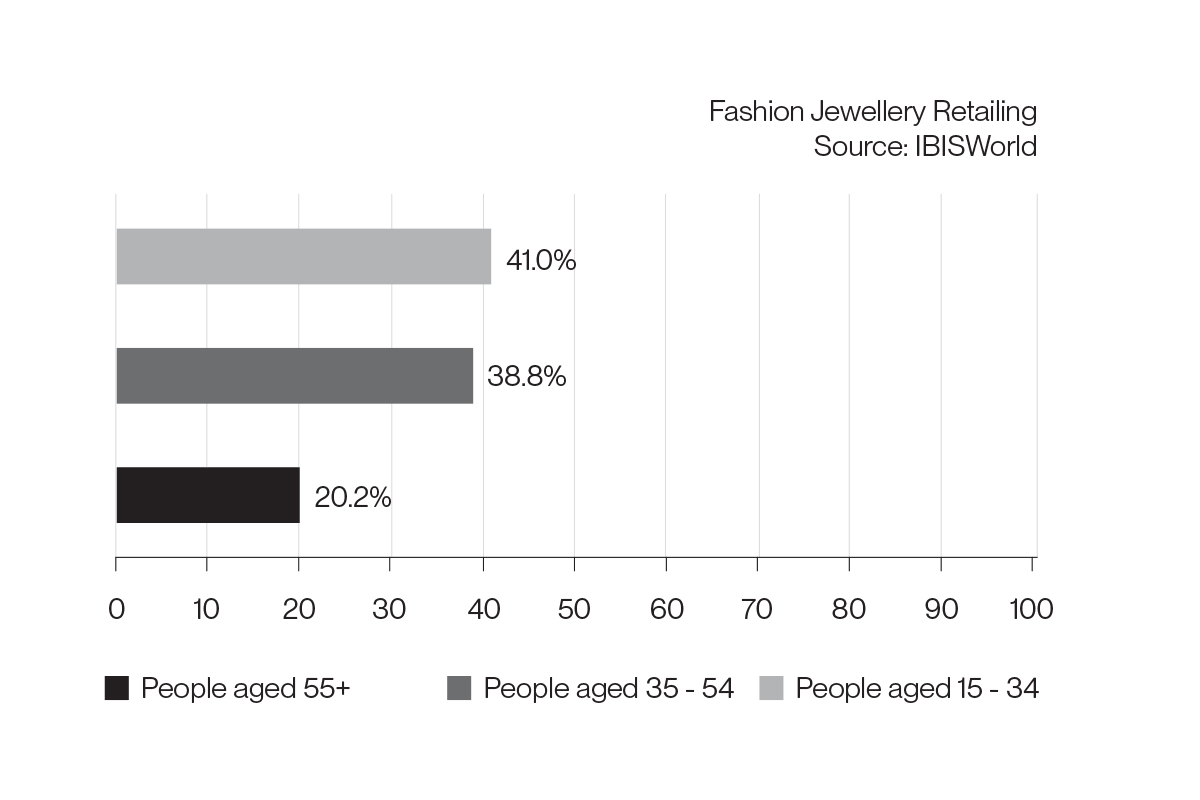

Demographic data has revealed a clear generational divide when it comes to fashion jewellery purchases. Breaking down the data into three age demographics allows us to observe trends and gain a deeper understanding of each group.

People aged 15 to 34 fall into the youngest demographic, comprising Generation Z and Millennial purchasers. The jewellery market among young shoppers has been relatively limited due to their smaller discretionary income compared to other age groups. As a result, high-priced pieces are typically inaccessible. Because of this, the younger demographic tends to purchase fashion jewellery that is affordable and easily accessible. In order to keep up with fashion trends that are influencing this age group, retailers are turning to online marketplaces and obtaining celebrity and

influencer endorsements on social media to help monetise this market.

The middle demographic made up of those aged 35 to 54 years consists of older Millennials and Generation X. With trends and fast-fashion on

the rise, this demographic has a major market segmentation of 38.8 percent of the fashion jewellery industry. Despite this, this age group has more established careers which increases their spending power, typically their fashion jewellery purchases are as gifts for their children or younger

family members. However, higher incomes are causing a shift in this group’s spending habits. We are more inclined to see this demographic

save up and buy fine jewellery instead of purchasing cheaper fashion jewellery alternatives.

People aged 55 and over have been bucking the trend of fashion jewellery. As they age and gain greater financial stability, this

generation has become increasingly attracted to fine jewellery. Their economic establishment means that valuable pieces are no longer

beyond their reach – instead, Baby Boomers view these items of luxury as worthy investments for enjoying now and passing on later.

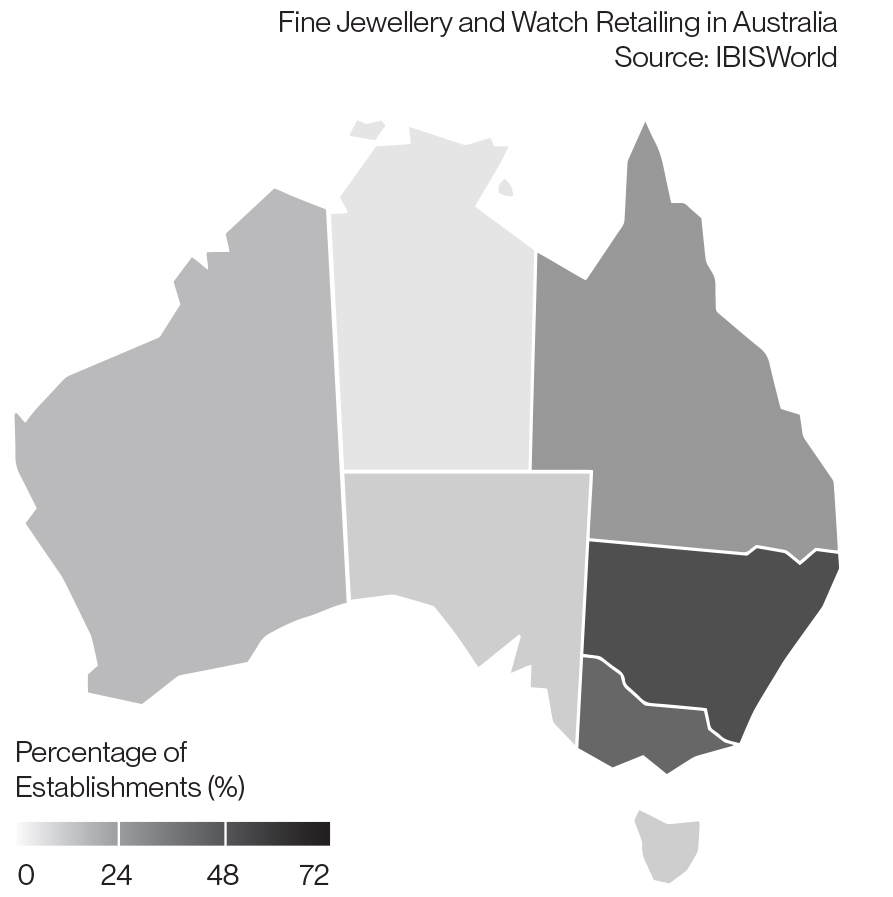

State by state Businesses

Australia’s jewellery industry is an ever-growing sector, with certain states distinctly leading the way in overall growth and development. By acquiring an in-depth knowledge of the Australian jewellery industry, businesses can seize opportunities to break into innovative areas and capitalise on existing markets.

New South Wales

New South Wales features a thriving commercial sector, with nearly one-third of the nation’s population calling it home. Shopping in Sydney is particularly advantageous – fueled by increased tourist spending and high pedestrian traffic throughout the city.

Jewellery manufacturers in New South Wales have taken advantage of their location to ensure a trouble-free and cost effective production process. By operating close to suppliers, they are able to easily facilitate the entire supply chain with significantly lessened transportation expenses.

New South Wales is the country’s epicentre for fashion jewellery. Major shopping centres such as Queen Victoria Building and Westfield Sydney attract droves of customers looking to accessorise with these fashionable pieces.

Victoria

Melbourne boldly asserts its place at the centre of fashion in Australia, continually displaying a passion for trend-setting and style. Retailers of fine jewellery and watches are capitalising on the desires for fashion and luxurious lifestyles among this state’s consumer base, making it the perfect place for industry professionals to expand their horizons.

As Australia’s fashion capital, Victoria is home to the second largest share of retailers known for their array of fashionable jewellery stores. International and domestic visitors alike flock to enter the Melbourne market with major players like Mimco choosing prime locations to capitalise on this traffic.

Queensland

Queensland continues to be a desirable state for many Australians, with recent figures demonstrating the nation’s highest population growth rate fueled by an influx of interstate migrants. As the state’s industrial sector grows, more companies such as Michael Hill are setting up shop. Boasting a head office in Murarrie and an onsite workshop nearby, this brand is making its mark within Brisbane’s thriving landscape.

Queensland, along with the Gold Coast is a popular tourist destination and boasts the fourth largest mall in Australia, Pacific Fair Shopping Centre.

Other states

The fine jewellery industry in Tasmania, Northern Territory, Western Australia and South Australia presents a unique opportunity – the chance to develop an untapped market. Exploring these areas could prove beneficial for those looking to make their mark within this sector.

Competitive Landscapes

As the fine jewellery industry flourishes, competition intensifies. This rise in engagement presents exciting opportunities for both established and new players alike. The internal competition within this industry proves to be on the basis of price between competing fine jewellery and watch retailers. Most operators in this industry release seasonal collections and capitalise on peak periods such as Valentine’s Day and Christmas. Incorporating loyalty programs like Michael Hill’s Brilliance program. Programs like this give an edge to consumers in an otherwise heavy spending period which creates a major incentive for customers to return to them over their competitors.

External competition for the fine jewellery industry proves to be fashion jewellery. With the fashion jewellery industry producing pieces similar to fine jewellery that are made with inexpensive materials, second and lowest household income and younger age demographic quantiles are more inclined to purchase fashion jewellery due to its affordability. The online jewellery marketplace also proves to be a factor of this competition. With an influx of online-only jewellery stores entering the market, shoppers are now being offered a much wider variety of competitively priced options than ever before – intensifying price competition within this sector. Additionally, the online-jewellery resurgence proves beneficial to foreign-owned players. The fine jewellery sector in Australia can stay competitive by actively infiltrating these spaces and trends.

Compared to the fine jewellery industry, the competition in the fashion jewellery industry is fairly high. Internally, retailers are competing with rivals on their price, selection quality, online presence, advertising and customer service. Consumers are increasingly looking for jewellery retail outlets that can provide a comprehensive fashion experience, eliminating the need to search various stores. As fashion jewellery is cheaper, price is a crucial selling point for retailers, which proves a major risk if they cannot compete with their competitors.

Externally, the fashion jewellery industry is in constant competition with department stores, online operators and fine jewellery retailers. Stores like Myer and David Jones offer a range of fashion jewellery, however they are not considered a part of the fashion jewellery industry as it is not their sole activity. Purchases in these stores dampen revenue for fashion jewellery retailers.

In the past five years, online-only fashion retailers have experienced a significant rise in competition as more and more of them add fashionable jewellery to their product offering. Additionally, ecommerce has facilitated easier access to overseas markets – meaning homegrown retailers are now pitted against imports. Simply, not existing in the online market is detrimental to business.

Industry Forecasting

The fine and fashion jewellery industries prove to be ever-evolving spaces with many factors that determine their power. In order to stay competitive and ahead of the curve, retailers, designers and suppliers must consider consumer sentiment and economical and social changes that can impact revenue.

Online retailing has proven to be a major key player in the jewellery industry. Not incorporating online facets is proving to be a detrimental decision in the jewellery industry, limiting your accessibility for consumers forces them to make purchase decisions elsewhere. However, because of the massive selection of jewellery online and ultimately the similarities in trends throughout both the fine and fashion jewellery sectors, the lines between which is which will begin to blur. As industry players move through the online marketplace, they will have to incorporate many sales and marketing decisions to stay competitive.

Introducing niche areas to your business proves to be one way to stay ahead of rivals. Whether that be small retailers incorporating additional services, or taking a pledge of sustainability to attract younger consumers, finding and claiming your corner in the industry will set you apart. Even though you may find your niche, slow growth in real household discretionary income can deter consumers from making expensive purchases. To make a push toward positive consumer sentiment, businesses need to make an emphasis on perfecting their customer service. Industry performance is expected to recover over the next five years with the projected consumer sentiment to rise, and where consumer sentiment is positive, spending is occurring. Fine jewellery and watching retailing revenue is projected to grow by 1.8 percent, reaching $4.1 billion.

The jewellery industry is continuously adapting and transforming, making it essential for companies to stay knowledgeable regarding consumer preferences in order to remain successful. Keeping up with changing trends can be the determining factor between thriving businesses and those that aren’t able to keep pace. Achieving success can only be attained when one has a firm grasp on their target market. Knowing who your consumers are and what they need is essential in order to reach new heights.

Further reading: