Drawing from the comprehensive insights of IBISWorld’s Watch and Jewellery Retailing in Australia 2024 report, a detailed examination of the Australian jewellery consumer comes together. With a commitment to providing factual analysis and precise discourse, this study provides applicable information regarding the current landscape of this dynamic industry. Through meticulous research, and a detailed exploration of trends, challenges, and opportunities, the Australian jewellery market presents itself to the industry.

Performance and Key Drivers

There has been a notable increase in demand for demi-fine jewellery in Australia, reflecting the current state of the consumer. The current trend in the jewellery industry is complex, presenting both challenges and opportunities. It reflects the changing preferences of consumers and the external market dynamics.

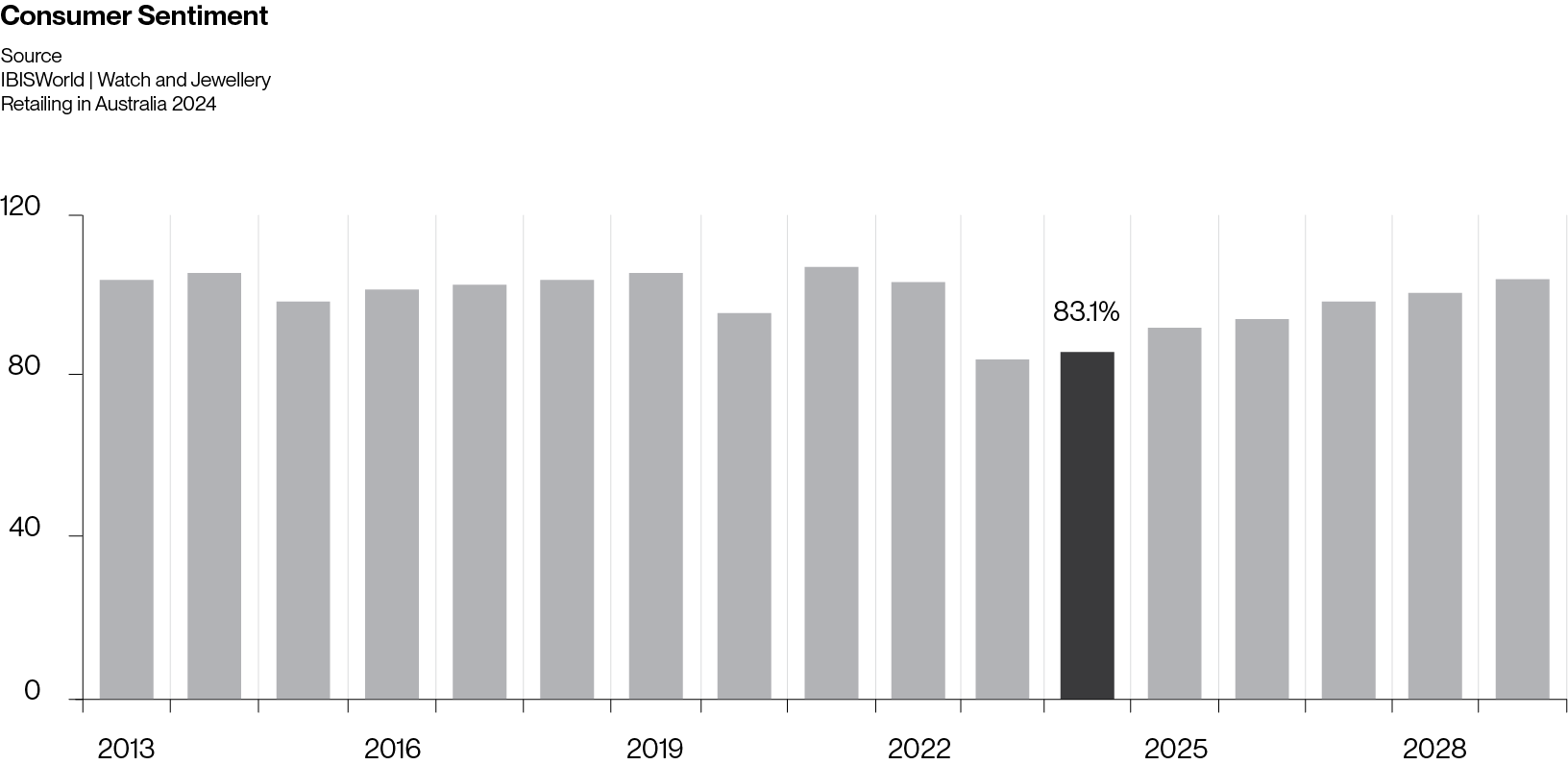

Although the demand for demi-fine jewellery is on the rise, this poses a significant challenge for mid-tier retailers who face tough competition, especially from the luxury and online segments. External factors such as consumer sentiment and discretionary income also play a crucial role in the growth of the industry. Currently, the consumer sentiment index is at a promising 83.1, creating a favourable environment for jewellery purchases.

Traditional retailers face mounting pressure to adapt digitally due to the prominence of online platforms. Adapting to these changes is crucial for sustaining relevance and meeting evolving consumer preferences. The watch and jewellery retailing sector features low concentration and moderate barriers to entry, fostering intense competition and innovation. External drivers, including increasing household discretionary income and favourable consumer sentiment, drive demand for jewellery, but the rise of online shopping platforms poses challenges for brick-and-mortar retailers. Navigating these dynamics is essential for sustained success within the industry.

Strengths, Weaknesses, Opportunities, and Threats

The watch and jewellery retailing industry possesses several strengths that underpin its competitive position in the market. Notably, the industry benefits from low customer class concentration, indicating a diverse consumer base with varying preferences and purchasing behaviours. Additionally, relatively high profit margins compared to sector averages contribute to the industry’s attractiveness for investors and stakeholders, reflecting the value proposition offered by jewellery products.

However, the industry also grapples with certain weaknesses. Leader among them is the high level of competition, stemming from the presence of numerous players competing for market share. This intense competition exerts pressure on pricing strategies and necessitates continuous innovation to differentiate offerings and capture consumer attention. Moreover, high capital requirements pose a challenge for new entrants and smaller players seeking to expand their operations or invest in technological advancements.

Despite these challenges, the industry presents several opportunities for revenue growth. Performance drivers such as the consumer sentiment index, which reflects consumers’ optimism about the economy, can stimulate demand for jewellery products. Leveraging this positive sentiment through targeted marketing campaigns and personalised offerings can unlock growth potential for industry players.

The jewellery industry is experiencing heightened competition due to the proliferation of online sales platforms. These platforms have increased consumer access to a wide range of products, leading to intensified pricing pressure on retailers. Moreover, the influx of cheaper imported alternatives has further challenged local retailers. To stay competitive, jewellery retailers are focusing on offering unique products, prioritising customer service, and leveraging influencer partnerships. Adapting to these trends is essential for sustained growth in the industry.

The convenience and accessibility offered by online platforms pose a significant competitive threat to traditional brick-and-mortar retailers. Adapting to this shifting consumer behaviour and effectively integrating online channels into their business models will be critical for industry players to mitigate the impact of online shopping on their revenue streams.

Impact of COVID-19 and Industry Growth

Amidst the unprecedented challenges posed by the COVID-19 pandemic, the watch and jewellery retailing industry experienced significant disruptions to cash flow and operational strategies. The pandemic accelerated existing trends towards online shopping, compelling retailers to swiftly adapt their business models to cater to shifting consumer preferences. With lockdown measures and social distancing protocols in place, brick-and-mortar stores faced reduced foot traffic and sales, prompting an increased reliance on e-commerce channels to maintain revenue streams.

However, despite these challenges, the industry is poised for growth in the coming years. One contributing factor is the projected rise in disposable incomes, as economies recover from the pandemic-induced downturn. With consumers regaining confidence in their financial stability, there is an anticipated uptick in discretionary spending, particularly on luxury items such as watches and jewellery. Moreover, industry players have embraced customised marketing strategies to engage with consumers on a more personal level, fostering brand loyalty and driving sales.

Looking ahead, the industry is expected to rebound from the setbacks inflicted by the pandemic, leveraging technological innovations and consumer-centric approaches to fuel growth. By capitalising on the growing demand for online shopping and implementing tailored marketing initiatives, watch and jewellery retailers can navigate the evolving landscape and emerge stronger in the post-pandemic era.

Future Outlook and Innovation

The future outlook for the jewellery industry appears promising, with anticipated revenue growth and market expansion projected over the next five years. This growth is expected to be driven by several factors, including rising disposable incomes, evolving consumer preferences, and innovative marketing strategies. To stay competitive in this dynamic landscape, jewellery retailers must focus on innovation in both product diversification and customer experience.

In terms of product diversification, retailers can explore incorporating new materials, designs, and technologies into their offerings to cater to changing consumer tastes. This may involve introducing sustainable and ethically sourced materials, incorporating customisable features, or leveraging emerging trends such as wearable technology.

Furthermore, enhancing the customer experience will be critical for retailers looking to differentiate themselves in the market. This can be achieved through various means, including investing in omnichannel retail strategies, offering personalised shopping experiences, and leveraging digital tools such as augmented reality for virtual try-ons.

Additionally, embracing sustainability and ethical practices will likely become increasingly important for jewellery retailers as consumers place greater emphasis on environmental and social responsibility. Retailers can differentiate themselves by adopting transparent supply chains, supporting fair trade practices, and promoting ethical sourcing of materials. Overall, by embracing innovation and focusing on enhancing the customer experience, jewellery retailers can position themselves for success in an evolving market landscape.

Consumer Sentiment Index

Household income quintiles significantly influence consumer spending on watches and jewellery. Examining these quintiles shows that each income bracket has distinct characteristics shaping their purchasing behaviours.

Among households in the highest income quintile, characterised by substantial net worth, demand for luxury items remains robust even during economic uncertainties. These consumers, endowed with high discretionary incomes, exhibit resilience against financial stresses, contributing to expanding the luxury jewellery market segment.

Conversely, the fourth income quintile, comprising households with above-average net worth, experiences fluctuations in demand due to changes in discretionary incomes and economic conditions. While these consumers typically invest in mid-range fine jewellery, challenges posed by economic uncertainty, particularly during the COVID-19 pandemic, have led to reduced spending and a contraction in market share.

Similarly, consumer sentiment in the third income quintile, representing the median range of incomes, significantly influences their purchasing decisions. Volatile consumer sentiment has hindered spending among consumers in this bracket, leading them to forgo purchases or opt for less expensive options.

Finally, consumers in the second and lowest income quintiles exhibit distinct purchasing behaviours due to their relatively lower incomes. These individuals tend to prioritise affordability and may opt for inexpensive fashion jewellery over higher-priced fine jewellery. Rising discretionary incomes have, however, enabled them to scale up their purchases to jewellery and watch items with higher price points.

Understanding these distinctions among household income quintiles is crucial for jewellery retailers in tailoring their marketing strategies and product offerings to effectively target different consumer segments.

Geographic Breakdown and Competitive Forces

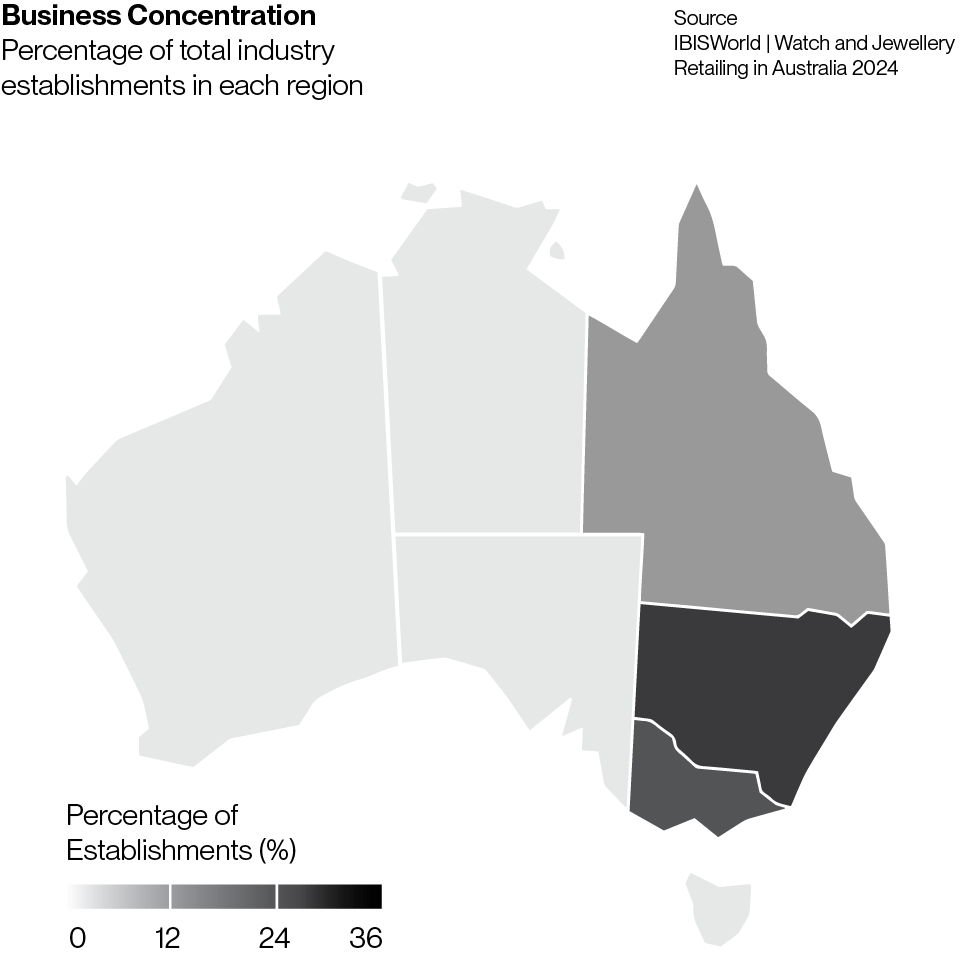

In examining the geographic breakdown of watch and jewellery retailers across Australia, it’s apparent that their distribution is influenced by factors such as population density and tourism. Major cities like Sydney, Melbourne, and Brisbane boast a significant concentration of retailers due to their high population densities and bustling commercial districts. These urban centres not only attract local customers but also serve as magnets for tourists seeking luxury goods and unique shopping experiences.

Tourist hotspots like the Gold Coast and Cairns in Queensland, as well as Sydney and Melbourne, are particularly attractive locations for high-end jewellery retailers. The influx of tourists, especially from overseas markets, presents lucrative opportunities for retailers to showcase their products and capitalise on the spending power of international visitors.

In contrast, states with smaller populations, such as Tasmania and the Northern Territory, have fewer watch and jewellery retailers. While these regions may have niche markets catering to local residents and tourists, the overall presence of retailers is relatively limited compared to larger states.

Competitive dynamics vary across states, with metropolitan areas experiencing more intense competition from department stores and online retailers. In contrast, regional areas may have fewer competitors but face challenges related to logistics and access to suppliers.

Watch and jewellery retailers in Australia tend to cluster in densely populated areas to capitalise on high foot traffic. Most of these retailers are concentrated in New South Wales, Victoria, and Queensland, reflecting the distribution of the population. Affluent regions with higher average incomes, like New South Wales and Victoria, attract more upscale retailers and drive high-value sales. Tourism also plays a significant role, especially in locations like Sydney, where luxury retailers cater to wealthy tourists. Overall, understanding the geographic distribution of watch and jewellery retailers provides insights into their strategic positioning and competitive landscape across different states and territories in Australia.

Trends Impacting Industry Costs

The jewellery industry faces several trends that significantly impact its cost structures and profitability. Firstly, rising rental prices present a considerable challenge for retailers, particularly boutique and independent stores lacking bargaining power. These establishments face increased financial strain as they compete for premium locations to maximise customer exposure. Secondly, retailers have been compelled to reduce staff hours in response to falling profit margins and rising purchase costs.

This reduction in staffing levels reflects the industry’s labour-intensive nature and the need to optimise operating costs. On the other hand, lower import costs have provided some relief to retailers, especially for fashionable jewellery imported from countries like China. This trend has enabled retailers to offer more affordable options to consumers, contributing to pricing pressures within the industry.

Lastly, intensifying competition, both from traditional brick-and-mortar retailers and online-only operators, poses significant challenges. Traditional retailers are faced with the need to adapt to changing market dynamics, including the increasing influence of online sales platforms and consumer preferences for cheaper imported alternatives. These trends collectively impact industry profitability and consumer pricing, requiring retailers to implement strategic measures to maintain competitiveness while ensuring sustainable profit margins.

Q Report and Showcase Weigh-In

The latest data from Q Report sheds light on significant trends within the Australian jewellery market, offering valuable insights into consumer behaviour and industry dynamics. According to Q Report, there has been a noticeable decline in the average retail value of engagement rings featuring lab-grown diamonds, dropping from $9868 to $7782 over the past year (April 2023 to March 2024).

Moreover, Q Report’s findings indicate a contrasting trend in the watch segment, with the average value of watches experiencing a 4.5 percent increase nationally. This divergence underscores the heterogeneous nature of consumer preferences within the jewellery market, emphasising the importance for jewellers to tailor their product offerings to meet varied demands.

Additionally, the data reveals a notable shift in the preference for yellow gold over white gold/platinum, with yellow gold now being used in 46 percent of jewellery compared to 32.2 percent previously. This shift underscores the evolving tastes of consumers and highlights the need for jewellers to adapt their product lines accordingly.

Showcase Jewellers Group’s findings echo the consumer shift observed in the Q Report data. According to their survey, nearly half of the members reported that less than a quarter of engagement ring sales involved lab-grown diamonds. Moreover, approximately 65 percent of respondents noted a decrease in the value of engagement ring sales, with the average sale value hovering just above $4000 per ring.

Beyond bridal and engagement categories, Showcase has seen upticks in the sale of yellow gold fashion jewellery and earrings, indicating a broader trend towards this metal choice among consumers. These insights from Showcase further illuminate the evolving preferences and purchasing behaviours within the jewellery market, offering valuable context alongside the Q Report data.

Overall, the insights complement the findings of the IBISWorld report, providing a comprehensive understanding of the current and past state of the jewellery industry in Australia within the last year. The integration of this data into our analysis shows that the last 12 months have been tough, but the predicted prospects from IBISWorld prove an interesting future.

From exploring market trends to analysing consumer sentiment and regulatory influences, we’ve uncovered the multifaceted factors shaping the industry’s trajectory. It’s evident that the industry is continually evolving, driven by changing consumer preferences, technological advancements, and economic fluctuations. As members of the jewellery industry, businesses must remain informed about these trends to adapt their strategies effectively. By understanding the market dynamics and regulatory landscape, businesses can navigate the jewellery market with confidence, ensuring their offerings meet the evolving demands of consumers.