The media has recently reported that BHP, the largest mining company in the world, has made a bid for the multinational mining company—Anglo American. The implications to the diamond industry are that Anglo American is the parent company that owns De Beers, the biggest diamond company in the world.

I think it’s a fair assumption that if BHP were to purchase Anglo American, it would sell De Beers. Why do I say this? A recent article in Forbes by Tim Treadgold stated. “Despite its century-old reputation and claim to be the custodian of the diamond industry De Beers has become more trouble than it’s worth, under attack from two directions.”

I think it’s more than two directions, and here is why. For those of us in the diamond industry, it’s clear that a combination of a world of uncertainty and international tension (not to mention economic hardship) has resulted in a slowdown of diamond jewellery sales, a major contribution to the natural diamond industry’s pain.

Ten years ago, BHP got out of the diamond industry. Originally, when it owned the EKATI and Chidliak mines, BHP recognised that mining minerals and dealing with the emotional components attached to diamonds didn’t fit their business model.

The next biggest contributor to the natural diamond industry’s pain is the enormous impact lab-grown diamonds have had. Clearly, setting up a whole warehouse of what I describe visually as “mini nuclear reactors,” to mass produce this beautiful gem can have significant advantages. For instance, avoiding needing to deal with foreign governments, needing to own large diamond mining operations, which must also address ecological, environmental, and social issues, all of which some might say are “a pain in the ass.”

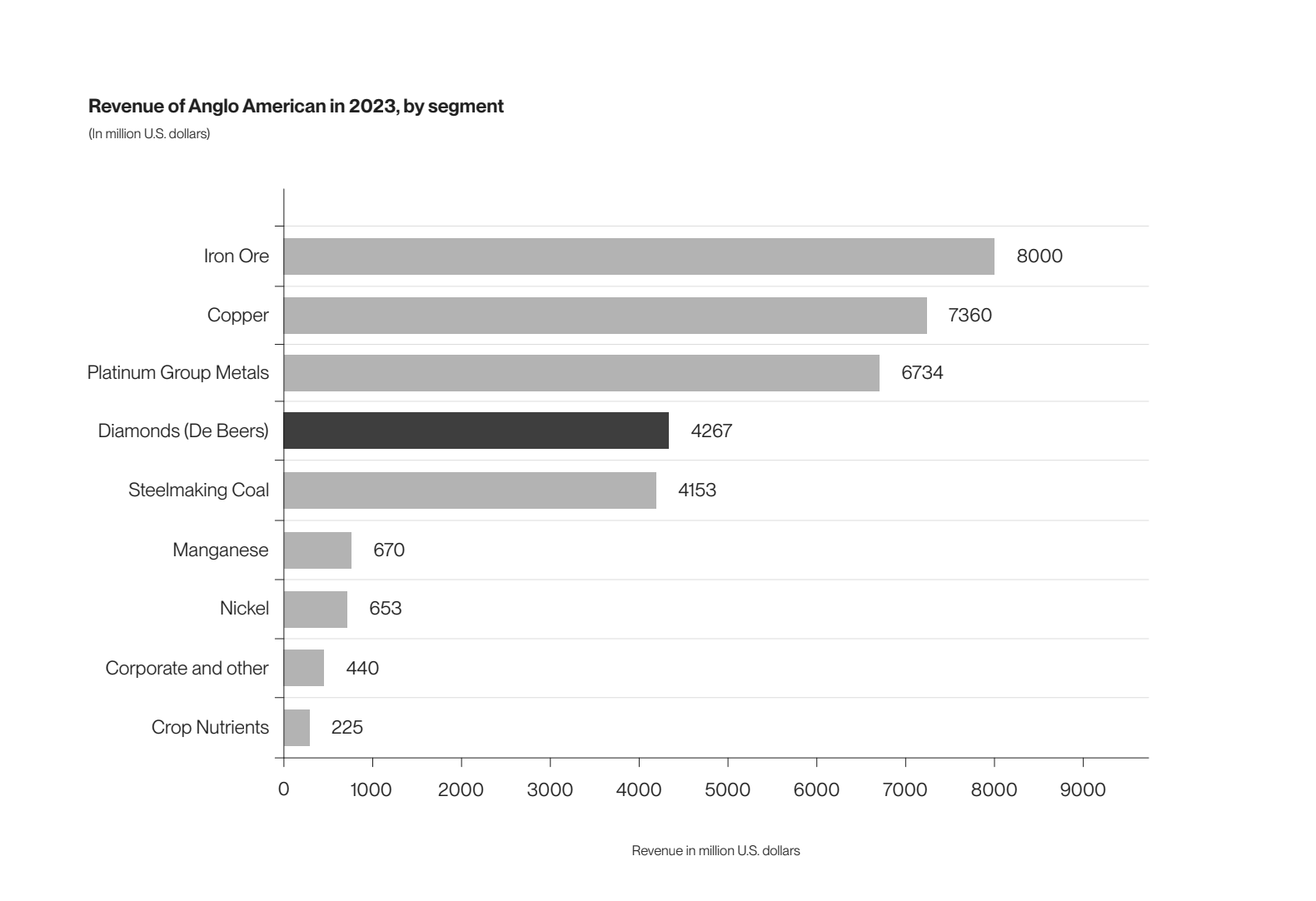

For those who read my last article about the G7 restrictions, we can throw this into the mix too. Don’t forget De Beers diamond sales in 2023 were $4.267 billion. However, above all, BHP is after the iron ore and copper resources. If you look at the graph by Statista, iron and copper alone are worth $15.3 billion to Anglo American.

In 2020, De Beers launched Lightbox, a lab-grown diamond to the market. I recall writing about Lightbox when De Beers did their big public launch of its lab-grown brand. At the time, I said I believed that De Beers had set this operation up on strictly commercial terms. You don’t spend a few hundred million dollars for any other reason than to make money. Clearly, launching a competitor to natural diamonds, by the biggest natural diamond company in the world sent out a clear message—this is a comparable product.

The argument which we have constantly heard by De Beers was that it launched the product to show it up as a legitimate product, but purely for fashion jewellery. They openly stated to the jewellery trade worldwide, that they believed they could drive the prices down of lab-grown diamonds to the point that it was seen as a fashion crystal. This would then protect the value of the natural diamond in the eyes of consumers, as being the only true value proposition when the consumer wanted to buy an engagement ring.

“I mean, who would want a lab-grown, or as some call it, a synthetic diamond for an engagement ring?” Fast forward six years and it is probably 25 percent of the engagement market worldwide.

I believe that De Beers miscalculated that they could control public sentiment and perception. It’s hard not to think that, for so many decades, you have been so successful with powerful marketing campaigns. We all are only now appreciating the power to sway the masses with social media, both commercially and politically. I must admit that I was gobsmacked that their marketing team thought they could resurrect a 20-year-old marketing campaign, “Diamonds are forever,” but maybe their research showed otherwise.

The jewellery world saw that De Beers has personally endorsed, with their new brand Lightbox, the legitimacy of lab-grown diamonds, and there was no going back nor closing that door. The next step was the massive profits that retailers could make. It became the easiest sale a jeweller could ever make.

Did Lightbox drive the price down? I don’t think Lightbox had any other impact on the market than legitimising lab-grown diamonds as an acceptable alternative in the engagement ring to natural diamonds.

I think that De Beers overestimated their influence in directing market sentiment for a product in which the retailer behind the counter cannot see the difference, never mind the consumer. That’s not to say it wasn’t possible it’s just that the marketing dollar investment and commitment weren’t there or they just read it wrong. Hey, we all make mistakes.

In the last six years, the price of lab-grown diamonds has plummeted due to massive competition and the ability to mass produce. This is strictly a supply and demand result. If we get back to the possible purchase of Anglo American by BHP, the question is, hypothetically, who will buy De Beers? There is talk of one of the luxury houses. Of course, there is only one or two who could contemplate such a deal. The alternative could be one of the Gulf Sovereign Wealth Funds.

These Funds are both strategically and geographically better positioned and would garner broad industry support to keep the current pipeline more accessible. However, a luxury house could rebuild the natural diamond story. The luxury brands know only too well how to do this. In addition, they could selectively support slicing and dicing the different quality of goods into the market, in a manner that creates clear definitions of value and cache. So, coming back to my original question, is De Beers a legacy or a liability to a company like BHP?

One thing is for sure, De Beers has proven over the last 136 years that it has evolved, adapted, and proven in the majority of cases an amazing ability to grow, manage and lead the diamond market. From an active observer’s perspective, I think the management team have a superior understanding of the leavers required to keep the market healthy and the importance of truly listening to their stakeholder’s position. Does the learning of the past put them in a perfect position to understand what needs to be done? Legacy. Or will the next buyer, if there is one, think they don’t want to take the chance, and let someone else re-invent the diamond story?

By the time this article is printed, we may already have an answer as to where this deal is heading. We must all stop and contemplate how this will impact our businesses and future.

Trade well,

Rami Baron