Australia is a rich country with an abundance of natural resources, many of which are instrumental to the jewellery industry. This month, JW looks at some of the exceptional and unique resources that Australia has to offer.

Geologically speaking, Australia is old. This means rocks and minerals are often found close to the surface so it’s no surprise that Australia is a big producer of opals and gold as well as being a major supplier of ruby, sapphire, garnet, diamond, pearls and topaz.

Australia is one of the world’s top producers of gold. The majority of production comes from open cut mines in Western Australia. Gold is an essential metal in jewellery manufacturing and for Australia overall, the gold industry contributed $23 billion to the economy in 2021 (Gold Overview, 2022).

Living alongside such unique resources and breathtaking landscape provides the inspiration for many jewellers to create stunning, one of a kind, Australian made jewellery.

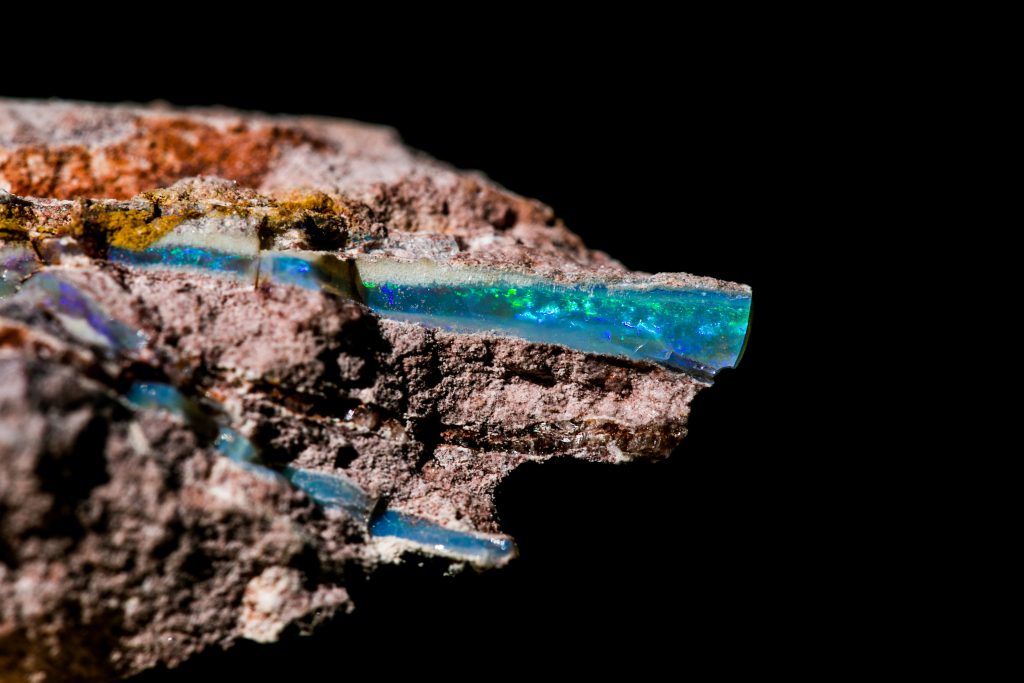

OPALS

1/17 https://www.cooberpedy.com/opals-2/

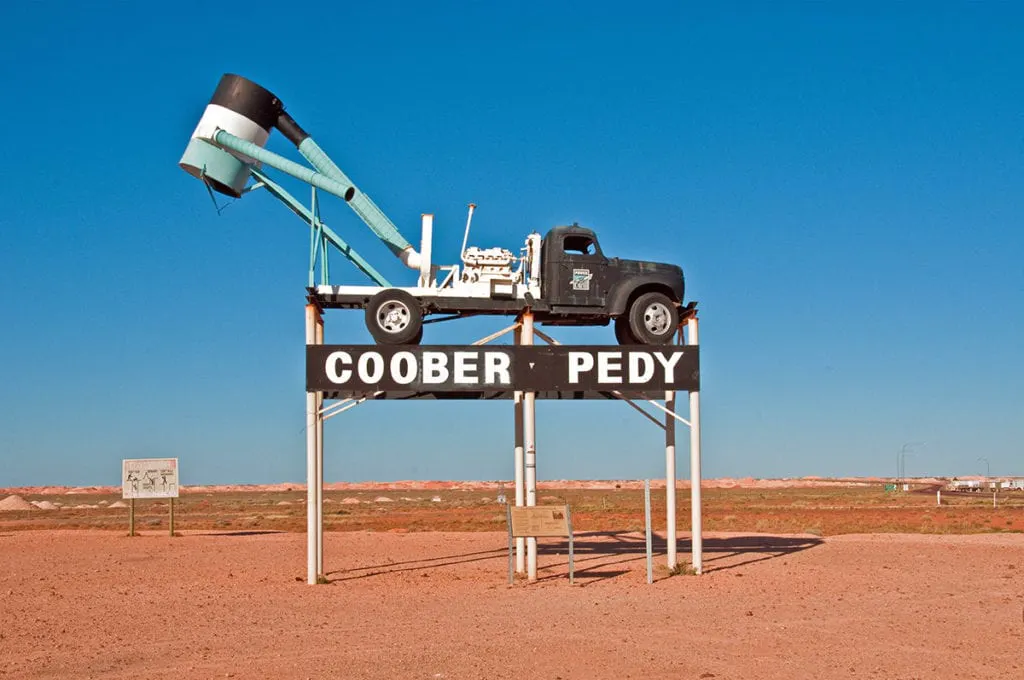

Australia produces 95 percent of the world’s precious opal and, unsurprisingly, this distinctive beauty is our national gemstone. The majority of Australian opal is mined in Coober Pedy in South Australia and black opal is found in Lightning Ridge in New South Wales.

Brilyanz Mance of the Umoona Opal Mine and Museum in Coober Pedy recognises what their customers expect when buying Australian opal.

2/17 https://www.gemsociety.org/article/opal-mining-coober-pedy/

“It’s important to our customers that the opal is genuine Australian opal, especially because the majority of our opal is Light Opal which has been found right here in Coober Pedy,” says Brilyanz. “Australia has the best gem quality opal in the world. In fact, Coober Pedy alone supplies an estimated 70-80 percent of the world’s opal.”

Brilyanz explains that while the majority of demand for Australian opal comes from overseas and international travellers, they are starting to see a change.

“We have seen a rise in Australian buyers within these last couple of years due to the Covid travel restrictions,” says Brilyanz.

With regards to designing opal jewellery, Brilyanz has witnessed some new styles emerging.

“We have definitely noticed some recent trends in opal jewellery, the biggest being opal engagement rings,” says Brilyanz. “A less traditional choice of ring in comparison to your classic diamond, but we are definitely all for it.”

3/17 Umoona Opal Mine and Museum

Now that the impacts of Covid have started to settle, the forecast in demand is positive.

“As a tourism town focused around opal and underground living, we are expecting to see a lot more international travellers and buyers,” says Brilyanz. “Within the past twelve months, we have seen a slow increase of people travelling Australia and through Coober Pedy as the restrictions have been lifted.”

Brilyanz is conscious of the volatility of the market, however spirits are high at Umoona Opal Mine.

“Opal is a luxury item that is increasing in value every three to five years on average,” says Brilyanz. “It is a market that is completely subjective to each individual person. You never truly know what to expect in an industry like this one. However, our hopes are high for the coming year.”

The passion and love for Australian opal from the locals in the community and the people in the industry is clear. Brilyanz explains the allure.

“Opal has the complexity and uniqueness of a fingerprint. The longer you look at it, at different angles and under different lighting, the more things you will see that you may have never noticed before. Each opal ring is quite literally one of a kind. While you can re-make the setting as many times as you wish, there will quite literally only ever be one of each stone. A beautiful sentiment.”

4/17 Umoona Opal Mine and Museum

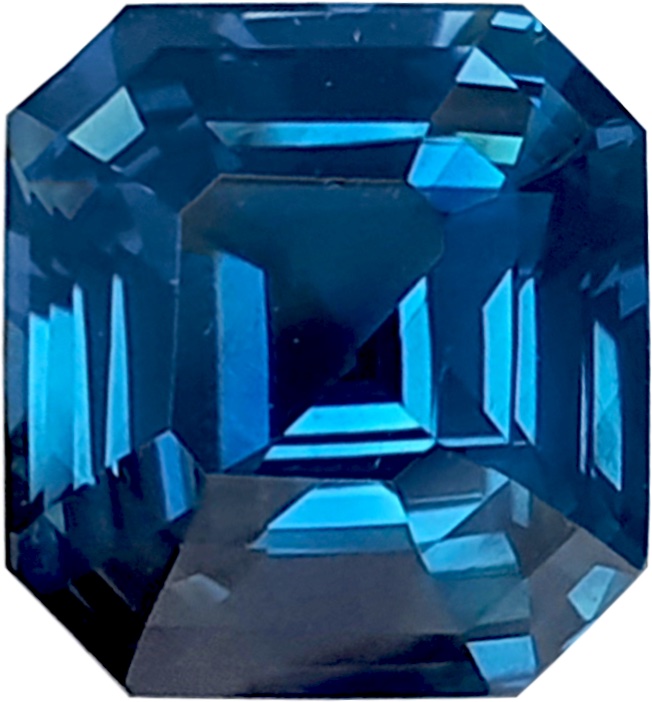

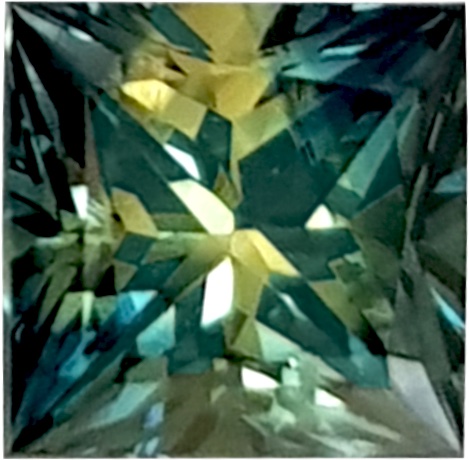

SAPPHIRE

Grant Hamid of Hamid Bros Gem Merchants is a wholesale gemstone merchant supplying the trade and has a distinctive eye for trends and changes in demand for Australian resources.

5/17 Hamid Bros

“International demand for Australian gemstones is higher for opal, diamond and pearl but Australian sapphire doesn’t seem to be as popular internationally,” says Grant. “And although demand in Australia is reasonably high for sapphire, the supply is limited due to lack of material and the high cost of mining and cutting.”

6/17 Hamid Bros

Grant explains that while the demand currently for certain types of sapphire are high (parti, green and teal) they’re less available. But when they were available years ago, they were not so much in fashion.

7/17 Hamid Bros

“The Australian sapphire mines have been producing for over 60 years and the increasing cost of mining compared to the yield being produced restricts availability of quality stones,” says Grant.

Because the demand for Australian resources is high, wholesalers often rely on imports for popular coloured gemstones.

8/17 Hamid Bros

“Although the demand for coloured gems has increased dramatically over the last 15 years Australia does not commercially produce the majority of these gems such as pink, purple and vivid blue sapphires, aquamarine, tsavorite, spinel, tourmaline, beryls etc and rely on material imported from numerous countries,” he says.

9/17 Hamid Bros

At Langford Gems, a wholesale jeweller in Hahndorf, Adelaide, Kendall Langford has a true feel for the changes in demand for Australian resources.

10/17 Hamid Bros

“I’m predicting Aussie sapphire is staying strong. It’s growing in popularity and it’s local,” she says.

Now that the effects of Covid have started to settle, Kendall has hopes for the industry.

“I think there’s caution amongst consumers with the current economy,” she says, “but hopefully, all the rain in the east coast of the country means the drought has broken and sapphire mining can resume.”

Aside from sapphires, Kendall is also a big fan of other Australian gemstones.

“I think we as an industry should build the interest in Australian zircons,” she says. “So readily available and in gorgeous pink, purple, orange and brown tones.”

11/17 Hamid Bros

GOLD

The role that gold plays in Australian history and identity development is significant. The first discovery of gold was in the 1800s, however the early findings were mostly kept quiet by authorities for fear that it would disrupt the workforce. They imagined that if people knew there was gold to be found, all of the public servants, convicts and soldiers would leave to mine for their fortunes.

12/17 https://investingnews.com/types-of-gold-deposits-in-australia/

Once a gold discovery in Bathurst was publicised in 1851, it initiated a surge of interest in the area and spurred a gold rush. The only armed rebellion in Australian history was over the miner’s licence system, where miners fought against troopers in the Eureka Stockade. Plenty of the country’s rural towns, transport, foreign trade and communication systems were bolstered by gold discoveries.

Following the pandemic, the global demand for gold jewellery jumped 52 percent to 2,124 tonnes (Gold Overview, 2022). In Asian countries such India and China, the demand for gold jewellery is high and ever-increasing. While these gains in demand for gold are promising, they have not yet returned to pre-pandemic levels.

Cameron Alexander, the general manager of commercial development at The Perth Mint, predicts a positive forecast for Australian resources.

“Demand for Australian precious metals remains incredibly strong thanks to global economic uncertainty and a post-Covid recovery in the jewellery market which has lifted demand for both gold and silver,” he says. “The Perth Mint recorded an exceptional level of demand in 2022, with requests for our products regularly outstripping supply.”

Cameron notes the international interest for minted products and coins comes predominantly from the USA and Germany while the market for their 1kg bars is seen in China and India.

“The outlook for 2023 is robust with higher precious metals prices forecast which will again boost investment demand for both gold and silver,” he says. “Early signs suggest physical gold sales will start the year on a positive note in the lead up to the Lunar New Year. But after that, a lot will depend on the international response to economic conditions and or threats.”

At Morris and Watson, operations manager James Bishop was cautious at the start of last year in forecasting sales as they expected unpredictability.

“We were unsure if demand would settle back into pre-Covid purchase behaviours when government stimulus packages ended and interest rates were raised,” he says. “Happily however, we have seen a continued growth and interest in gold within our bullion, refining, fabricated and cast metal products and services. We are optimistic that most aspects of the current trend will continue into 2023.”

13/17 https://www.australianmining.com.au/news/australia-delivers-record-gold-output-amid-covid-19/

While James is confident that there will always be demand for gold jewellery, he has noticed a shift in consumer behaviour to other alloys.

“Our clients and their customers are looking into metal options that are budget friendly but with a higher gold content than 9ct and an alternative to white gold, respectively,” he says. “Although fabricated metal sales for handmade pieces are still strong, there has been an increase in demand for casting services, possibly linked to jewellers wanting to reduce metal waste because of higher per gram rates for gold alloys.”

PEARLS

One of the rarest and most sought after types of cultured pearls in the world is the white south sea pearl. Predominantly farmed along the north west Australian coastline, these precious gems are renowned for their timeless beauty and classic style.

14/17 Pearls of Australia

Australian south sea pearls have the additional drawcard of being independently certified as the world’s most sustainable and ethical choice by the Independent Marine Stewardship Council. The isolated and pristine environment in Western Australia allows for a large and quality yield of this natural resource.

15/17 Pearls of Australia

Paspaley’s executive director Peter Bracher speaks to what he believes drives the interest for Australian resources.

“In recent years, increased interest in social and environmental issues among consumers has added an additional layer of desirability for Australian products including pearls and mother of pearl,” he explains. “Australia’s standards in working conditions, environmental standards and low corruption rate are well known and highly valued around the world. These factors will only increase in importance in future years.”

Additionally, Peter estimates the market for Australian pearls to remain strong into this year.

“The Chinese customs department recently released a statement specifically identifying Australian pearls as a highly desirable product among Chinese consumers,” he says. “These statements are influential because Chinese businesses use them as market indicators for particular products.”

16/17 Pearls of Australia

The fashion trends and broader inclusion of jewellery styles and designs is also helping drive pearl sales at Paspaley.

“Pearls are currently very much in fashion around the world and are appealing to a wider demographic that now includes men and women of all ages,” says Peter. “They are increasingly being used in avant garde ways and no longer have the conservative associations they sometimes did in the past. In addition to this, demand is currently greater than supply which should support the market in the absence of a significant decline in economic conditions.”

At Willie Creek Pearls, CEO Paul Birch recognises the characteristics that are now essential to consumers and significant factors that drive their purchases.

“For the majority of our customers, not only is it important that they understand the origin of the pearls they are purchasing, but more specifically they want to know that they are purchasing their pearls from a Western Australian, family owned pearl producer who can guarantee both provenance of the pearls and that they are produced with respect to the environment,” he says. “Like all industries there continues to be a growing expectation that Australian resources are farmed sustainably.”

Luckily, the demand for pearls was not negatively impacted through Covid and Paul is not expecting this to change in the future.

“Due to the reputation of producing the largest and finest quality pearls in the world, the market for Australian pearls remains strong.”

17/17 Pearls of Australia

At Pearls of Australia, manager director James Brown addresses the value that their customers place on the guarantee their pearls are farmed in Australia.

“It is no longer enough to state our pearls are produced in Australia,” he explains. “We need to certify the origin and authenticity of the pearls and demonstrate that best practices (including no chemical treatments or colour/lustre enhancements) are applied thoroughly and consistently through the whole value chain.”

“Source of origin has always influenced consumer behaviour,” he continues. “It reveals national and cultural preference, and also reflects an evolution of social consciousness towards nature conservation and restoration.”

In line with other pearl farms we spoke with, Jodi can see the demand for pearls has a positive relationship with the sustainable nature of the farming practices.

“The price of good quality pearls is at an all-time high,” he says. “In light of ongoing climate pressure, we don’t expect this value to decrease. Perhaps more importantly, the unique position of this intrinsically sustainable gem and the related appetite of the next generation for more responsible and sustainable luxury items, may maintain the value of a pearl.”

“The value cursor for pearls has moved a lot over the past 100 years since the inception of pearl cultivation,” he says. “Natural pearl value remains largely pegged to rarity and this has further increased as a result of the depletion of natural oyster populations in most oceans of the world.”

Australian resources are unique, highly sought after and abundant, which is good news for the jewellery industry. The contributors we spoke with have positive future forecasts and have shown strong results despite recent threats such as the pandemic. The demand for provenance, sustainable practices and high farming/mining and extraction standards are what set such a high bar and desirability for Australian products and their exclusive and spectacular beauty make them a cut above the rest.

References:

Collins, T. (2011). Australia’s Gold Industry: Trade, production and outlook. Retrieved December 21, 2022, from https://www.dfat.gov.au/sites/default/files/australias-gold-industry-trade-production-and-outlook.pdf

Gold Overview. (2022). Retrieved December 21, 2022, from https://www.goldindustrygroup.com.au/gold-overview

Further reading: