While Australian and international coloured gems are in more demand than ever, COVID-affected supply lines have put a hard brake on supply. Here with input from four players in the coloured gemstone industry, we explore what the supply and demand has been like for coloured stones, what the major trends are, and what the future looks like.

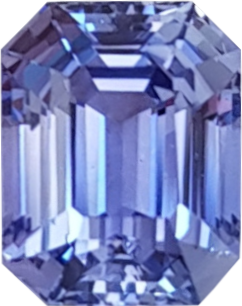

1/15 Hamid Bros Sapphire 1.92ct 7.35 x 6.3mm

Our contributors all stated that demand and thus business has remained vibrant over the past few years, but supply is tightening in various markets for various reasons. Scott Langford is owner and gem cutter at Hahndorf-based gem wholesaler and lapidary Langford Gems, and he said demand is still high, particularly for teal sapphire.

“Prices are climbing and rough material is harder to find and getting more expensive…even cut stones are climbing in price.

“For us, the demand for coloured precious stones is as high as ever and growing at a consistent rate.”

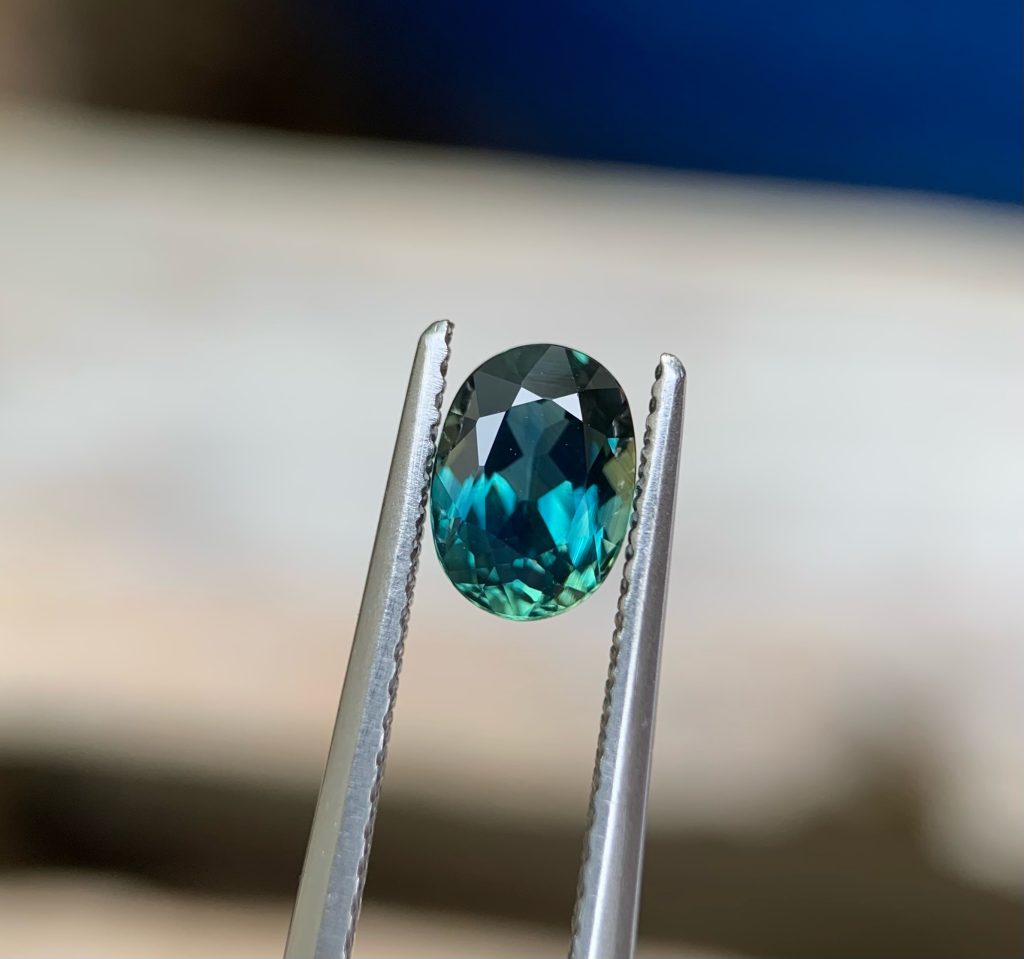

2/15 Hamid Bros Sapphire 2.73ct-8.8-x-7.1mm

On a similar note, director Grant Hamid from gem merchants Hamid Bros. said good business has been paired with short supply.

“…the market for fine quality coloured gems has been very buoyant these past few years as clients seem to be interested in various different gemstones in fine quality and cut.

“The only difficulty is sourcing sufficient quality material to satisfy demand.”

3/15 Langford Gems Teal Australian sapphires are in high demand. These were cut by Scott. Oval from Rubyvale, QLD, AU and round from Tomahawk Creek, QLD, AU

Coolamon Mining is a major central Queensland sapphire mining company headed up by co-owners and husband-and-wife team Jim and Jenny Elliot. Jenny said that Australia’s supply continues to decline due in part to mining resource areas being worked out, but also increasing government imposts and restrictions. Like Scott and Grant, Jenny attested to the increasing demand for sapphires, also paired with the requirement that suppliers be able to guarantee they are natural stones of Australian origin.

“The availability of supply of larger sapphires, in excess of one carat, is becoming increasingly difficult, and as a result, the price for larger stones has increased significantly – provided their origin and authenticity can be guaranteed.”

Brendan McCreech, managing director of O’Neils Gems, said they are as busy as ever, and described the coloured stone market as ‘healthy’ and ‘thriving.’

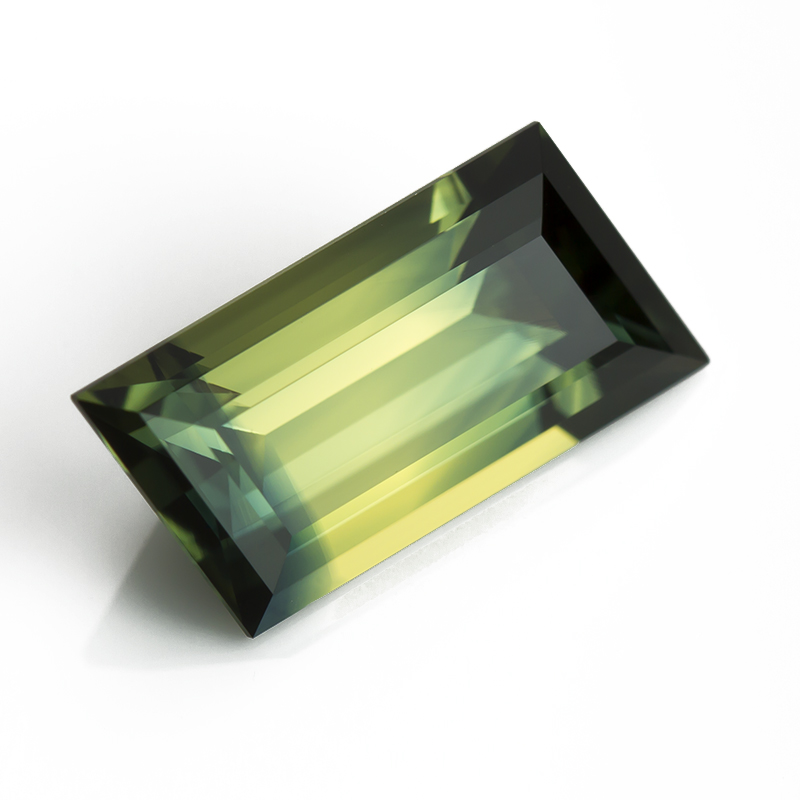

4/15 Hamid Bros Parti Sapphire 1.18ct 7.3 x 5.3mm

“Sales are steady across our full range, and we are optimistic about the next 12 months.”

Teals, blues, and parti, the big gemstone colours of choice

There appears to be a surge in demand for blues, teals and parti coloured stones with all three colours being popular for both engagement and dress ring stones.

5/15 Coolamon Sapphire Parti Baguette Sapphire

O‘Neils has seen blue Ceylon sapphires as the most prominent alternative to diamonds for engagement stones and Brendan said they’re followed closely by rubies. “Other coloured stones are occasionally requested, but the hardness and tradition of corundum usually wins out.”

Jenny said that Coolamon Mining had experienced huge demand for teal sapphire colours over the past few years, a demand which has been hard to fulfil.

“The current demand seems to be shifting more towards parti-colours and, while the demand for good blue stones remains constant, and the golden yellows remain the highest priced, larger parti colours are now also commanding quite high prices.”

6/15 Hamid Bros Spinel 0.70ct 5mm

She said sapphire has become even more popular for engagement rings, and not necessarily just for the main stone.

“There is an increasing demand for either single or multiples of smaller stones for engagement rings.”

Scott agreed that teal is in extraordinary demand at the moment.

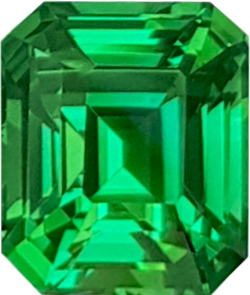

7/15 Hamid Bros Tsavorite Garnet 1.47ct 6.9 x 5.9mm

“Especially and almost exclusively in sapphire.”

He also attested to sapphire being a popular engagement ring stone, in mainly blue/greens and parti colours.

“Fancy peach/apricot colours are also popular…hard to get though.”

8/15 Hamid Bros Spessartite Garnet 1.36ct 6.0mm

“Opals have grown in popularity for engagement rings but we advise our clients that opals are too soft for everyday wear.”

He said spinel, tourmaline and morganite are growing in popularity as engagement ring stones due to their colour and affordability.

For Hamid Bros., it’s pastel colours that are all the rage with Grant reporting tones such as lightish blue, pink, yellow and padparadscha sapphires being popular choices for engagement ring stones, in addition to teal and parti sapphires.

“In the softer stones: emerald, morganite, aquamarine and tsavorite garnet are in constant demand, although not necessarily recommended for engagement rings.”

9/15 Hamid Bros Pad Sapphire 2.08ct 8.3 x 6.4mm

He said sapphires remained the best and most popular non-diamond stones for engagement rings due to their hardness, affordability and great range of colours.

Pandemic fallout continues with shortages and soaring stone prices

Huge swathes of global supply chains were impeded during the pandemic, causing widespread disruptions to all major industries. Two years later, and now all that accumulated workforce shortage and supply chain disruption has led to an artificial spike in demand and soaring prices as a fully active supply chain works to ‘pick up the slack’.

Grant said COVID had affected every part of the coloured gemstone industry’s supply chain from the mining areas, to the dealers who fly in and out, to the cutting factories that have seen reduced staff numbers.

“Nothing has been easy and some material is difficult to find on a regular basis.”

10/15 Hamid Bros Rhodolite Garnet 1.28ct 7.4 x 5.6mm

He said because of all this, the Sri Lankan/Madagascan sapphire prices had risen dramatically, closely followed by ruby, pink, and padparadscha sapphires.

“Teal sapphires have increased a lot from a low base and Alexandrite of quality is higher than ever.

“Tourmaline of all colours and spinel have also seen significant price increases.”

11/15 Hamid Bros Purple Sapphire 1.54ct 6.3 x 5.6mm

Echoing Grant’s sentiment, Scott said lockdowns affected every facet (pun intended) of the coloured stone industry with rough gem mining, rough trading markets, gem cutting factories, and exporting processes all being locked down for extended periods, as well as freight and shipping facilities slowing down.

“Sri Lanka’s current economic crisis is really impacting their ability to export their gem products. The global energy supply crisis has affected cutting factories. As demand increases and supply lessens, prices are skyrocketing.”

Langford Gems has seen the biggest rise in sapphires, rubies and emeralds of all tones, and aquamarine and opal have risen slightly.

12/15 Hamid Bros Pad Sapphire 1.45ct 6.9 x 5.5mm

On the sapphire mining front, Jenny said that while demand has increased, it’s hard to foresee any significant increase in availability due to the decreasing mining returns, reduction in viable mining resource areas, and increasing bureaucratic controls and restrictions on miners.

“Exploration by us and other miners to date has not been successful in discovering any new viable mining areas, and a number of potential areas are locked up in national parks or other restricted government reserve areas.”

Regarding prices, she said COVID travel restrictions had the greatest effect as they prevented local suppliers, jewellers and buyers from travelling overseas to buy. However she said this had the positive effect of increasing travel within Australia as interstate Aussies became aware of the quality of sapphire being mined right here and being sold at prices comparable to international stones.

13/15 Hamid Bros Emerald 0.86ct 7.5 x 5.6mm

She said because of the above factors, the price of all good quality sapphire of guaranteed Australian origin has increased over the last two years, with the most significant increases being the teal and parti colours.

Brendan said the COVID disruptions had created an interesting process for O’Neils Gems considering they travel to select a few stones from thousands.

“We have relationships with suppliers going back decades who understand the quality need, so during COVID they would send three to four times the quantity we needed for us to select.”

He said while this process was long-winded, it worked well. “It’s the incidental stones you come across while travelling that COVID effected, but we’re rectifying that right now with extended buying trips.”

Similarly to Jenny, he saw the optimistic side of the COVID-affected market in jewellery consumers re-discovering local, talented manufacturing jewellers.

“We have a wealth of world-class talent that deserves to thrive.”

14/15 Langford Gems Hexagon shaped parti coloured Australian sapphire cut by Scott from rough sourced from Tomahawk Creek, QLD, AU

Supply stranglehold set to continue

Looking ahead, Jenny said that the government’s refusal to relinquish their industry-hamstringing regulations would mean the availability of good quality Australian sapphire will continue to decrease.

“The Queensland Government now has a moratorium on the granting of any new small mining tenures and has increased imposts and restrictions on existing miners.”

Scott attributed pop culture as having played a part in the public consciousness around Australian gemstones, with the public becoming more aware and interested in gemstones and gemstone mining thanks to shows like Outback Gem Hunters and Outback Opal Hunters. However, he seconded Jenny’s issue that mining is becoming more and more regulated and harder for the miners.

15/15 Hamid Bros Yellow Sapphire 2.57ct 8.4 x 6.6mm

“More mining restrictions are implemented for environment and resource sustainability which makes mining more difficult and expensive. This added cost filters down the chain to retail end.”

However, he said social media and the internet have enabled miners to sell their wares direct to the public, netting them a higher price.

“Some miners are now cutting their own rough, rather than selling rough, and selling the cut gemstones in the public arena which achieves them a higher profit margin.”

Grant also agreed that Australian gemstone mining had declined substantially due to lack of material and falling commercial viability, but felt the demand would remain strong over the next few years.

“…there appears to be a consistent trend to clients wanting something individual and unique and a greater awareness of the various stones available in an array of colours.”

Read below for related stories: