As a first mover to launch lab-grown diamonds (LGDs) in the Australian wholesale space and a second-generation diamantaire, most of my colleagues shook their heads when I first launched LGDs. Today, what does the landscape look like?

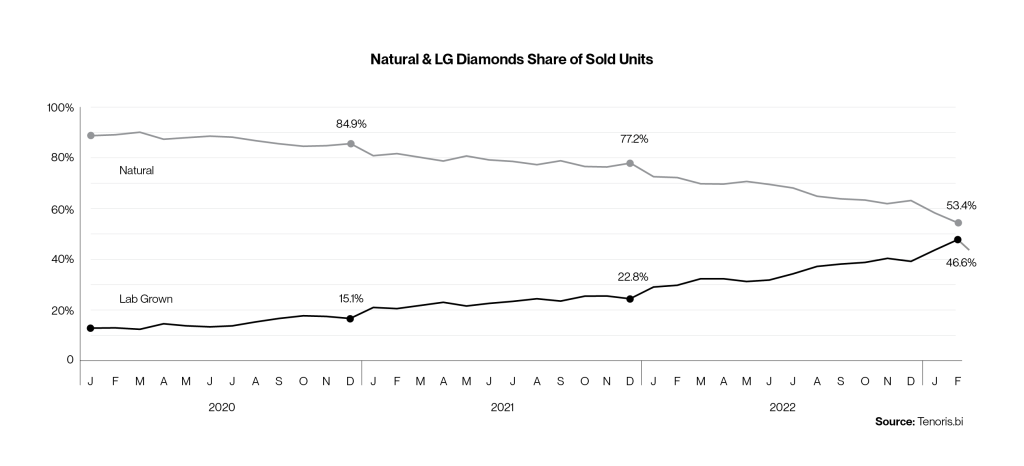

Based on data collected by Tenoris (a leading trend analytics company, supplying retail and consumer trend data out of America), around half of the global demand for diamonds is from the USA. Their data reflects that loose lab-grown diamond unit sales held a share of 11.6 percent in January 2020, and as of February 2023, 46.6 percent. Edahn Golan from Tenoris recently mentioned that an estimated 50 percent of loose diamonds sold by American jewellery retailers are expected to be lab-grown diamonds before the end of 2023. This reflects a big turning point for our industry.

The prices of lab-grown have come down substantially since inception, this is no surprise. We all knew this would be the case, as it is with most new products that come to market. My company, JC Jewels encouraged our clients to only hold minimal stock of fast sellers to ensure a healthy stock turn until the pricing of LGDs stabilised. Due to mild uncertainty and only knowing that this stabilisation would take time, our advanced B2B portal changed the way Australian and New Zealand jewellers buy their diamonds. We provided the tools needed to buy on demand in real-time and hold less inventory at all times.

If at some point this year loose lab-grown and natural diamond sales are equal, or lab-grown exceeds 50 percent of loose diamonds sold in the engagement ring category, what will the diamond business look like ten years from now? What if LGDs become the dominant consumer choice? If the average millennial is 35 years old today and the average Gen Z is 18 years old today, it is fair to say they will be the majority of engagement ring buyers for the next 15-plus years. They are the drivers behind lab-grown diamond success, whether they choose lab-grown for sustainability reasons or simply the price value proposition.

Buying a natural or lab-grown diamond is a consumer choice. Retailers must educate their clients, and be able to answer all questions. It’s then up to the consumer to what they choose to purchase. Gen Z is certainly connecting with LGDs the same way our parents engaged the age-old slogan “a diamond is forever”, spending three months’ wages on their bride’s engagement ring. What happens if LGD sales exceed natural diamond sales by a vast majority? Could this happen, and if it did, would diamond mines afford to continue mining with their fixed overheads? Many diamond mining companies mine other minerals. What if the ROI in mining diamonds drops, due to low demand? Do they move their mining resources to other minerals? DeBeers-Anglo American, for example, mines copper, diamonds, platinum group metals, iron ore, steelmaking coal, nickel and manganese. If diamond mining is not performing, they have many other minerals to mine that may achieve a better ROI.

This trend continues, coloured lab-grown diamonds are now seeing strong sales and demand in Australia (pink lab-grown diamonds for the most part). Natural Argyle pink diamonds are amongst the rarest diamonds in the world. Their unique colour and rarity command a high price, now with the Argyle mine closed, Argyle pink diamonds are akin to a collector’s item and an investment.

However, pink Argyle diamonds are not always financially attainable to all. The consumer is engaging in lab-grown as their opportunity to enjoy pink diamond jewellery that was not in their reach until now. This past year has also seen a strong demand for coloured lab-grown diamonds in blues and yellows. One of the main challenges with coloured lab-grown diamonds is the consistency in colours. Growers can’t simply grow the colours they want, and some limited growers can consistently supply these goods. We added these to our JC Jewels platform earlier this year due to demand. Jewellery is reaching the market and empowering consumers to enjoy coloured diamond jewellery. The jewellery they dreamed about in the past, not for investment but for the joy they get from wearing jewellery is one attribute that lab-grown diamonds gift to all.

As per the statistics above, today’s modern consumer has engaged with, welcomed and accepted lab-grown and coloured lab-grown diamonds. I believe all retailers should be offering lab-grown and natural diamonds, side by side, but with clear education and transparency governed and respected by all.

Craig Miller

CEO, JC Jewels

jcjewels.com.au

Further reading: