JW Mag spoke with veteran secondary market jewellery specialist, Tim Goodman, about the latest market trends for Australian pink diamonds.

Q. Tell us about your time in the jewellery business

I started after I left school as a runner along Castlereagh Street back in the seventies. I would take a second- hand stone from one dealer and try to sell it to another. If I made 5%, I would celebrate. I learnt how to eye grade a diamond the hard way, by trial and error.

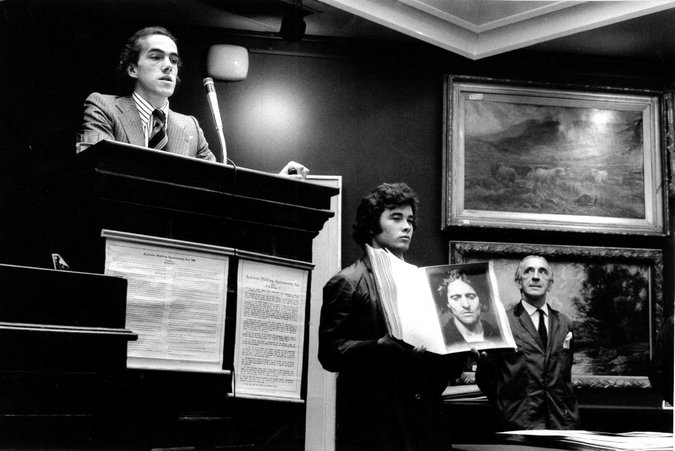

In the late seventies I rented a tiny office in the Trust Building on the floor below my uncle’s diamond merchant business, Goodman & Hollander. I started a specialist jewellery auction house. We had public viewings using police from the licensed dealer’s squad moonlighting as security guards in plain clothes. Needless to say, we were never robbed. In 1978 we sold a 1.56 carat RBC diamond to a “Griffith vegetable farmer” appearing in his overalls, for $170,000 dollars. It was a 1950s D/Flawless diamond ring creating a new Australian auction record.

I built that business into a $70million dollar fine art auction group covering collector’s cars, art, antiques and of course jewellery. In 2011 I sold all the auction houses to management buy outs.

Recently, I embarked upon the most exciting chapter thus far founding a technology business aimed at the global diamond trade. We have built and launched simple global diamond pricing apps and are building an auction trading platform to be launched next year.

Q. Your website says that you conduct public tenders of pink diamonds. Is this like the Argyle diamond mine?

No, we are not associated with the Argyle mine or its owner Rio Tinto. We are a democratized secondary marketplace for anybody to sell or buy fancy-coloured diamonds originally sourced in Australia. The Argyle mine used to conduct annual tenders of their most precious finds like many other diamond mines until they ceased operations in November 2020. Until then the mine had produced 90% of the global supply of pink diamonds.

Yourdiamonds.comTM is a facilitator providing a platform where sellers consign their stones to public tender. They may be a super fund, deceased estate, private collector or investor or they might be a merchant who wants to move some stock. The buyers are represented by similar groups except clearly, they are in acquisitive mode. Buyers at our tenders are located all over the world.

Q. What is the market like for second hand Australian pink diamonds?

Secondary market pricing is governed by supply and demand like any market. We have all seen the marketing and media reports about the growth rate in the price of pink diamonds. This has generally referred to the prices achieved at closed tenders exclusively for sight holders conducted by the mines. In other words, you have to be an invited member of the trade to bid. The secondary market (second hand) is quite different. Prices are determined again by supply and demand but the factors that influence price are determined more by the economic conditions of the day. Whilst interest from investors fluctuates, trade buyers take a longer-term view for stock. We have found that people who have acquired stones some time ago have enjoyed staggering capital gains. In our first tender we were appointed by the Fitzpatrick family of Brisbane to sell a collection acquired in the late eighties. A 2.00 carat 4PP RBC created an Australian auction / tender record when it sold for AUD$2.2million. We understand it was acquired circa 1988 for an extraordinarily modest price at a retail outlet representing the mine.

White diamonds have increased in value at global auctions by 15% since 2019. The average wholesaler asking price for white diamonds has increased by just 5% over the same period. It is clear that fancy-coloured diamonds have far exceeded their white cousins at auction and wholesale. However, the market for fancies is more opaque making price variations unclear.

The owner of the Argyle diamond mine, Rio Tinto, estimates that prices for pinks from the Argyle mine have appreciated by 500% at the mine’s private tenders over the past 20 years. Now the mine has closed with demand for pink diamonds never greater as prices continue to rise.

It has been more challenging to achieve a capital gain when selling stones acquired more recently. Retailers must pay their rent and make a profit. I guess it takes a while for secondary market pricing to catch up. But it certainly has done so spectacularly.

Q. What should buyers bear in mind when buying pink diamonds on the secondary market?

It’s all about colour when it comes to pinks. Clarity is relevant but not nearly as much so as for white goods. A red diamond is the most valuable followed by a purplish pink (PP) down to a very pale pink, light champagne pink or brownish hue pink stone being the least valuable. They have all gone up in value, but the reds have gone up the most. Blue stones are similar. A top pink or a 1PP colour using the Argyle terminology, is also highly

sought after and exceptionally rare.

My grandfather used to say, “It’s all in the buying”. If you buy really good quality and you buy right you will always come out in front.

About Tim

Tim Goodman founded Bonhams & Goodman, Sotheby’s Australia Pty Ltd and owned and operated Leonard Joel. The auction group enjoyed the

largest jewellery auction business in the Southern Hemisphere. Tim’s family had been in the diamond trade in Castlereagh Street, Sydney since 1864. Most recently Tim founded Yourdiamonds.comTM

Read below for related stories: