In a momentous revelation shared with Business Insider, Cormac Kinney, chief executive officer of Diamond Standard, and diamond analyst Paul Ziminsky, have disclosed insights into the imminent surge in diamond prices.

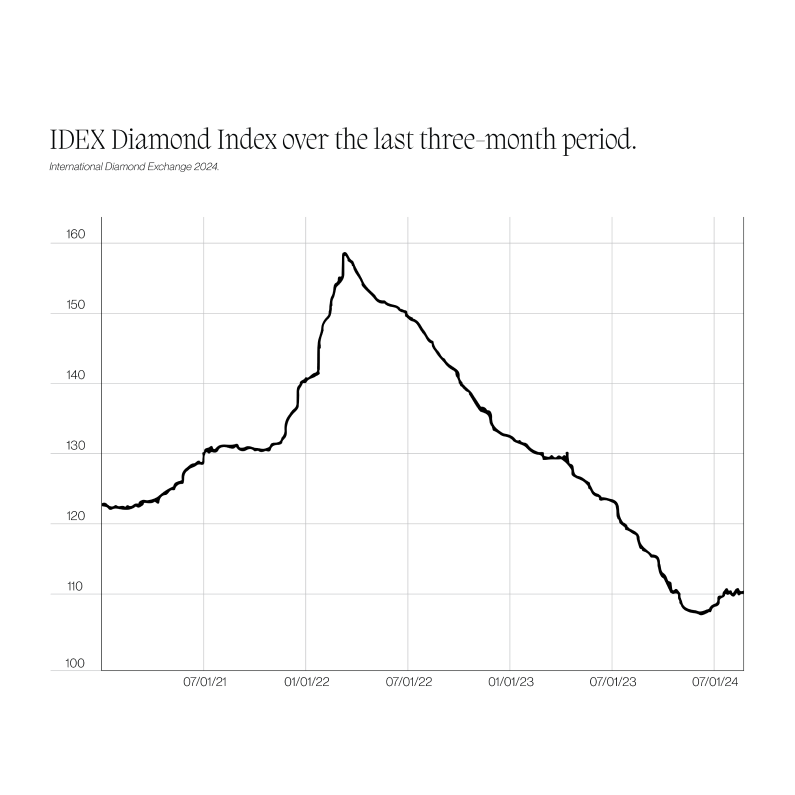

After weathering a lacklustre 2023, characterised by a staggering 30 percent decline in diamond prices across all categories, the industry is gearing up for a noteworthy reversal. Projections suggest a potential upswing of up to 10 percent over the next year, fueled by a confluence of factors reshaping the diamond market.

A critical factor propelling this surge is the intentional tightening of the diamond supply. In stark contrast to the overproduction witnessed in 2023, major industry players, including the Russian mining giant Alrosa, are actively implementing measures to curtail supply. Alrosa’s strategic decision to pause rough diamond sales for two months in 2023 aligns with broader industry efforts to stabilise and recalibrate the market.

The recent geopolitical development of the G7 ban on Russian diamonds adds a layer of complexity to the supply landscape. This ban has the potential to reduce the global diamond supply by an estimated 30 percent, a factor Kinney emphasises, foreseeing a profound impact on the diamond market.

Advertisement

“There’s a major disturbance in the force,” Kinney tells Business Insider, drawing attention to the significant geopolitical repercussions on the diamond industry.

Despite the challenges faced in 2023, the diamond market is showing signs of resilience. The International Diamond Exchange’s Diamond Index, surpassing a level of 110 in January, suggests a turnaround after a prolonged two-year decline.

An anticipated surge in demand also plays a pivotal role in the forecasted uptick in diamond prices. Following a subdued 2023, indicators in the US engagement ring market, a significant segment, point to renewed interest. Google search interest for engagement rings increased by 10 percent in the third quarter, signalling a potential rebound in consumer demand.

Kinney and Ziminsky not only anticipate a short-term rebound but project a more significant upswing over the next two decades. With investors increasingly eyeing diamonds as a hard asset, Kinney draws parallels with the trajectory of gold prices, which have seen a remarkable 500 percent increase since 2003.

As other commodities face challenges and downward trends, the unique forces propelling the diamond market suggest a positive outlook.