Argyle pink diamonds and pure gold come together in The Perth Mint’s most prestigious release of the year, and first since the Argyle Mine’s closure. Here with input from Argyle Pink Diamonds, The Perth Mint, several pink diamond ateliers, suppliers and jewellers specialising in pink diamond jewellery, we examine this coin’s numismatic glory, the state of pink diamonds, and their future.

An exquisite exaltation to Australian gold and Argyle diamonds

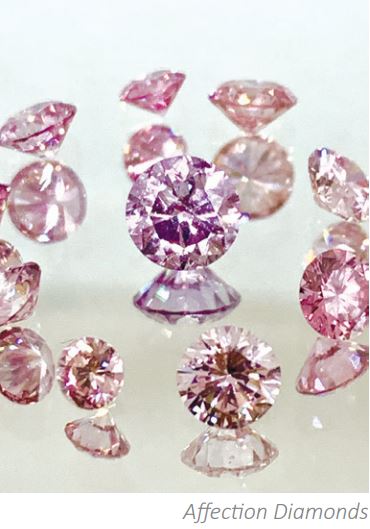

The Jewelled Horse coin was released on 18 January, and it follows similar luxurious Perth Mint pieces which celebrate animals significant in Chinese culture such as the Phoenix in 2018, the Dragon in 2019 and the Tiger in 2020. Pavé-set with 169 specially selected Fancy Intense, Vivid Pink and Purplish Pink diamonds to a total weight of 2.76 carats, the coin is just one of eight minted, and The Perth Mint product page describes it as the “numismatic embodiment of equine vitality, power and nobility.”

The Perth Mint’s General Manager Minted Products, Neil Vance, said that all previous Jewelled series have sold out, and at time of writing, five of the eight Jewelled Horse coins have sold.

“People are genuinely enamoured with pink diamonds and their unique features,” he said.

“Now with the prospect of these rare and exquisite diamonds no longer being mined, this makes them especially sought after.”

One of the five fortunate buyers of this coin was Julian Farren-Price, director of long-running Sydney jeweller and watch retailer J Farren-Price. Julian said he was thrilled to acquire one of the eight coins, having previously purchased and sold the Dragon, Phoenix and Tiger coins.

“All the coins have been stunning but I must say the Horse is especially beautiful, the pink diamonds seem particularly strong in colour and the design is magnificent,” he said.

“This is in fact one of the pieces that I am not very fussed if I sell or not as it really is so collectible for the future.”

Sales and Marketing Manager of Argyle Pink Diamonds, Marie Chiam, said that the market understands Argyle pink diamonds’ collectability, and thus pieces like the Jewelled Horse speak to their incomparability and value appreciation.

Market turmoil after Argyle’s end

All our contributors agreed that Argyle’s closure has caused a remarkable rise in the interest in and price of pink diamonds, with varied accounts as to how it’s affected them. Marie said that the market is well aware of the market fundamentals of Argyle pink diamonds – with no known source of supply to replace Argyle, combined with an insatiable demand built off the back of 37 years of production.

“We saw this in the results of our 2020 Argyle Pink Diamonds Tender with a record number of participants and continued double digit price growth,” she said.

“The prices of our annual Tender diamonds have grown over 600 percent since 2000.”

Director of Mondial Pink Diamond Atelier, Michael Neumann, said that the pink diamonds which sold in the 2020 Tender brought record prices.

“The knowledge that there will be only one more Tender and new production limited to the last batch of ore extracted in November, has certainly seen upward pressure on prices and scampering within the trade and public to secure pink diamonds now,” he said.

Leibish is a New York-based internationally recognised specialist and online retailer of high-end diamonds and jewellery, with expertise in natural fancy coloured diamonds and gemstones. Founder and president Leibish Polnauer said that Argyle’s closure had a dramatic effect on Argyle Pink Diamond prices across all categories.

“It raised the interest for investment, for collecting and owning historical diamonds,” he said.

Leibish said the 2020 Argyle tender contained 20 stones over 1ct and Leibish’s company bought 10 of them.

“The interest of investors to own an Argyle Pink Diamond over 1ct from the tender is very strong.”

Stelios Palioudakis is director of Perth jewellery store Stelios and he said has been heavily involved in buying and selling diamonds over the past five years, having witnessed the increased interest and corresponding prices over that time.

“In the past you could always find what you wanted or something similar, (but) as the mine closure approached the price seemed to go up monthly as goods were disappearing at an alarming rate,” he said.

“Five-page stock lists were reduced to one in a matter of three months, the activity leading up to closure and post closure was nothing like we have ever seen before.”

Stelios said there was always a year-on-year price increase for Argyle diamonds, and that leading up to the closure, it commanded the highest prices ever. He said that for investors or buyers, it was no longer a case of carefully considering what a diamond ‘ought’ to cost, but rather “If you want it, this is the price.”

“I guess whoever buys the naming rights of Argyle will dictate what happens to the price next… Let’s hope it goes even higher!”

The response to the mine closure has been unprecedented for Julian and his team at J Farren-Price.

“Never before have I seen so much interest in pink diamonds,” he said.

“I am buying everything I can get and on the other side we are selling pink diamonds nearly on a daily basis.”

Julian went so far as to say that he considers the gems to be the “Monet of the diamond world”: ultra rare, collectable and valuable.

“We never promote purchasing as an investment, we are not investment advisors but the statistics show that pink diamonds have been appreciating at around 13% per annum over the last 20 years and our clients can draw their own conclusion around that.”

Echoing a similar sentiment, owner of Affection Diamonds Nirav Shah said that since the mine closed, it caused a massive increase in the enquiry and sales for pink diamonds, and there has been high demand for investment purposes as well.

The struggle to supply a slowly dwindling diamond

When asked about being able to supply their customers with the pink diamonds they want going forward, naturally most of our respondents all concurred that their stocks were good for now, as is their ability to source, but the end is inevitable, and it’ll be a scramble for the stones still available. Leibish said his company has the privilege of reliably supplying customers with pink diamonds, but only for a limited time.

“Even though we bought and hold many Argyle diamonds, the supply is finished,” he said.

“A stone we sold cannot be replaced.”

Sharing similar sentiments, Julian said that all good things must come to an end, and so the privileged position J Farren-Price holds in being among the small group of original Ateliers for Argyle diamond is going to change somewhat.

“I suppose there might be a year or two of production in the pipeline but after that it will be incredibly difficult to source nice pink diamonds,” he said.

Mondial’s mission, as taught to Michael by his father and founder Fred Neuman, has always been to individually select each diamond in their stock for quality and value.

“We try to choose the best colours and finest clarity, over having any diamonds which may be compromised by heavy flaws,” he said.

“We do our best to acquire the pinks which are uncommon, unique in some way, so that our clients have the opportunity to purchase not just any pink (or blue, or yellow or champagne/cognac) but something which is a shining and premium example of what the mine has to offer.”

At Affection Diamonds, Nirav said his company will continue to sell Argyle pink diamonds until their stocks run out.

“(Then) we will source more which are available around the world in future,” he said.

Stelios said he has plenty of pink diamonds to use in jewellery for the foreseeable future.

What happens to the coloured diamond industry now?

With Argyle closed, the Alrosa mine in Russia has taken over as the largest producer of coloured diamonds in the world. Most of our respondents are happy to continue purchasing, investing and selling what Argyle pink diamonds remain available and have not given life after Argyle too much consideration. However, Leibish is one company which has cast a wide net, with the president reporting that his company is buying and manufacturing pink diamonds from many different sources.

“If we see the right goods in Alrosa at the right price, we will buy by them also,” he said. “Argyle’s greatness was not its huge magnitude of pink diamonds production but in their incredible fruity colours – let’s see If Alrosa can show something similar.”

Nirav believes that once Argyle stones are finished from the market, Russian pinks will be more popular and Affection Diamonds will be happy to sell according to their clients’ needs.

Stelios’ focus once pink stocks are depleted will be on large white diamonds and semi-precious stones.

“Moving forward in production, we are already cutting rough diamond in a lot of other fancy colour diamonds,” he said.

Stelios also believes Argyle pink diamonds are headed for a similar fate as Kashmir sapphires.

“The Kashmir sapphire mine had same circumstances as Argyle: the mine closed and it produced the world’s best sapphires. Now the prices are crazy and it’s impossible to find them.”

Another who is shifting focus to white diamonds is Julian, who suspects it’s a great buying opportunity.

“…whites could become the new pink,” he said.

As for coloured diamonds, Julian shared Stelios’ views and said many people fail to understand that there has not been a new diamond mine found in the last 30 years.

“It is predicted that in the next 30 years we could see the end of all diamond mining in the world if something new is not found,” he said.

Unfortunately Michael does not believe there will be any significant new mines or sources of coloured diamonds here in Australia, but there will always be an appetite for natural coloured diamonds, and the coloured diamond market is sustainable.

“It’s simply a question of to what level,” he said.

“We have every intention of continuing to be heavily invested in coloured diamonds in the future because we are passionate about them and have decades of experience purchasing and designing jewellery with them.