WRITTEN BY Sylvie Dibbs

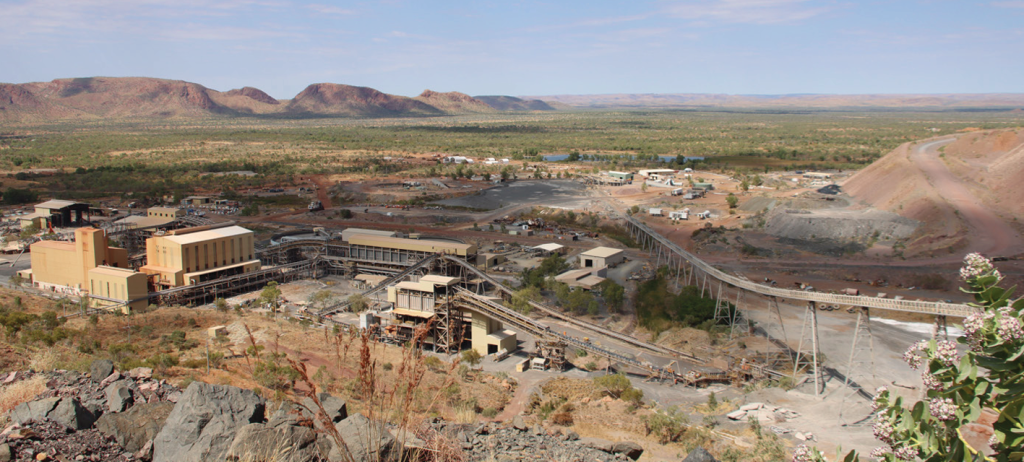

The closure of the Argyle Diamond Mine in November 2020 marked the end of a special era within the coloured diamond industry. Located in the remote East Kimberley region of Western Australia, Argyle was renowned for its production of rare fancy-coloured diamonds, including the ultra- coveted pink and red stones that accounted for over 90% of the world’s supply. With mining operations ceasing after 37 years, the industry has been left navigating a new landscape for sourcing and promoting these extraordinary gems.

The End of an Iconic Supply Chain

Over its operational lifetime, Argyle produced more than 865 million carats of rough diamonds. While much of its output consisted of accessible champagne and cognac diamonds, it was the vibrant pinks, reds, and occasional blues that captured global fascination. Since its closure, the rarity of these stones has intensified, driving prices upward and creating a scarcity that challenges both consumers and businesses.

The closure has also sparked questions about the mine’s remaining inventory. Argyle’s “final tender” in 2020 was followed by several exclusive events, including the release of the Art Series 1 and Art Series 2 collections and the sale of a “last remaining parcel” to Tiffany & Co. These post- closure sales showcased rare historic diamonds and previously held inventory, reinforcing the mystique of Argyle diamonds while raising speculation about deliberate market strategies to sustain their value.

A Shifting Market

For businesses and consumers, sourcing Argyle diamonds has become increasingly complex. These highly sought-after stones are available not only through Argyle’s network of official partners but also through independent wholesalers, private collections, and secondary markets like online platforms.

The rise of the secondary market is a natural consequence of the mine’s closure. Private sellers, aware of the increased value of their diamonds, are approaching retailers, wholesalers, and even fellow consumers. In uncertain economic times, these sales present opportunities for resellers but also introduce new challenges, such as ensuring proper valuation and authentication to verify the diamonds’ origin and legitimacy.

Beyond Argyle: The Next Chapter

While the Argyle name continues to evoke prestige, the focus has shifted to sustaining consumer fascination. Initiatives such as the Argyle Icon Partners project, which creates one-off artistic jewellery pieces, keep the legacy alive. These creations maintain the conversation around Argyle diamonds and preserve their aura of rarity and artistry.

Looking Ahead

The closure of the Argyle Diamond Mine has undeniably reshaped the coloured diamond industry. Its legacy endures through the unparalleled beauty of its stones, but the future lies in adaptability and innovation. How will the industry continue to capitalise on a mine that has been closed for years? How does Argyle reinvent itself to remain relevant in contemporary industry conversations? As this new chapter unfolds, collaboration,

support for resellers, transparency, and creative strategies will be essential to preserving the allure, demand, and value of these remarkable gems.