The pandemic has taken a negative toll on many industries but there have been some positives for the diamond sector, according to President of ALTR Created Diamonds, Amish Shah, who observed that diamond jewellery has been one of the most desirable gifts during the Covid-19 period. Here Mr Shah responds to a series of questions on the diamond industry, referencing the Bain & Co Global Diamond Report 2020-2021.

Q: In 2020, rough diamond production decreased by 20% compared with 2019 levels. Last year, rough and polished prices fell by 11% and 3% respectively. The mix of diamonds remained largely constant with medium and large diamonds accounting for 25% of production volume in carats but around 70 – 80% value in US dollars. Can you elaborate?

The rough diamond production in the last few years has seen a decline in certain articles as various mines, to the best of my knowledge, are on the verge of closure and certain mines have already had to close last year due to profitability. When we look at the Earth-mined category there is also one new shift that we’ve seen that has affected Earth-mined diamonds coming to the marketplace as well as their consumption. Lab-grown diamonds and their increased consumer acceptance has made a direct impact on the pricing as well as the need for the same amount of supply that it had in the past.

Each year there is more Earth-mined diamond rough being brought into the marketplace than is actually consumed for fine jewellery and sold in stores. This increased disparity has had a direct impact on pricing.

How did the onset of Covid 19 affect the diamond mining companies and their production output?

During the Covid-19 pandemic a lot of the mining companies had to put a hold on production not only because of social distancing issues but also due to the moratorium that the Indian manufacturers put into effect. This moratorium requested every importer of diamond rough to stop importing any new Earth-mined diamond rough into India for manufacturing. This had a direct impact and forced the hands of miners to either stop production or stockpile the supply on their side. So, when you sum it up, the impact has come from low consumer consumption from the pandemic, the moratorium from manufacturers, a sense of awaking by the midstream for the lack of margin, and the excess supply on the Earth mined side. As lab-grown diamonds continue to increase in acceptance and consumption, the boat on which the Earth-mined diamonds have sailed on until now has started to get more rocky than ever.

The pandemic saw the enforcement of travel restrictions and lockdowns throughout the world. What sort of changes occurred within the traditional diamond supply chain as a result of this extraordinary event?

The travel restrictions and lockdowns at the various mining, lab grown production centres, and the cutting centres had a direct impact on the entire supply chain. As we are aware, the second and third quarter of 2020 saw little to no diamond cutting or polishing coming out of India which happens to be where over 90% of the world’s supply comes from. This was further amplified by the moratorium that the Indian manufacturers put on Earth-mined diamond rough imports.

The positive impact that came out of the pandemic, after the destruction in all the supply chains, has been a clean-up of the existing inventory that was accessible at the national distribution centres of various countries as well as how the local retailers sold what they had in stock and only reordered what they needed from all the inventory that was accessible. It also led to a positive cash flow for the retailers and the distributors by lowering their inventory. While the world sees the pandemic in a negative way, the diamond industry capitalized on its cash flow situation. The cash flow of the diamond industry got positive at the retailer and distributor levels and will have a very positive impact in 2021 as distributors and retailers start restocking for the return of the consumer to their stores and online websites.

How did Covid-19 change consumer behaviour in the way purchases of diamond jewellery were made?

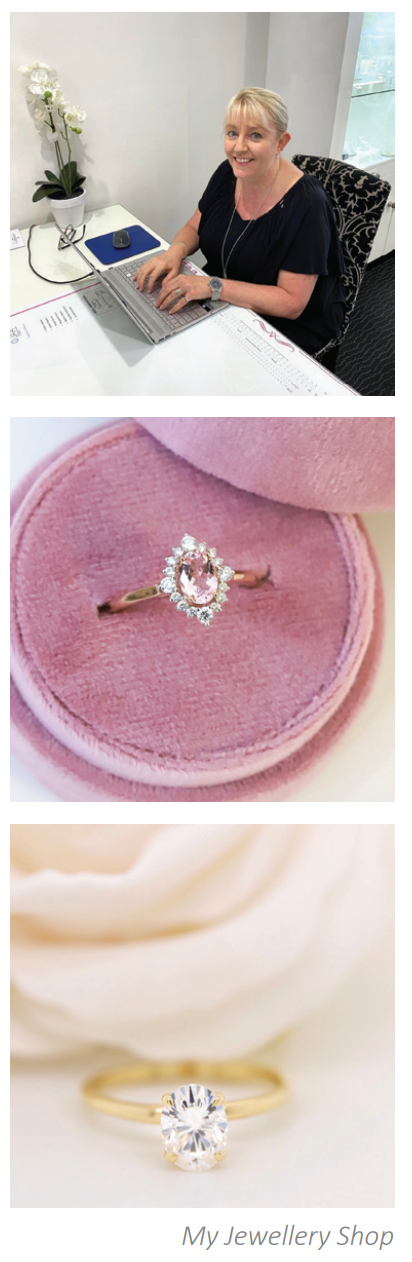

Diamond jewellery was one of the most desirable gifts during the Covid-19 period. Consumers were locked behind doors anywhere from one to six months with their loved ones. This allowed and forced them to connect with their loved ones and spend time understanding the value of relationships. The world had come to a stop and the only ones they had around were the ones they loved. This directly impacted various categories of consumer products that have always represented love and emotion. Jewellery specifically has always been a symbol of love and emotion and been gifted or self-purchased for special moments in life. Jewellery sales from the third quarter of 2020 peaked for retailers as consumers bought online and at curb side for their loved ones far and near. This helped the retail jewellery industry to meet their numbers for 2020 that they had originally planned for in spite of the pandemic.

What impact did the lockdowns and cross-border restrictions have on wholesale diamond sales and diamond jewellery sales though brick-and-mortar jewellery outlets?

The positive impact for loose diamond sales and jewellery to the wholesale distributors in various countries was that the jewellery outlets that they serviced purchased what was accessible and in-stock. The value of the stock during this period went up and the discounting on product went down. The brick-and-mortar stores that had a web presence did far better than the ones that did not. In the last decade, the jewellery industry has shied away from making investments as well as allowing their business to get technologically advanced. They preferred the experience in the stores and felt more in control. These stores felt the pain as the consumers who wanted to buy from them could no longer communicate except through video meetings and curb side pickups.

The stores who had robust websites, high quality photography, and a wide inventory online that represented what they carried in stores did far better because their existing customers as well as new customers felt confident and comfortable making those purchases. One thing that happened which was also learned by the diamond and jewellery industry during this period was the importance of branding and brands. Branded luxury sales during this time, including jewellery, was up double digits for 2020. Consumers felt more confident about the brand and the product.

The pandemic created more opportunities for online sales of diamond jewellery during 2020. What are your projections for sales of diamond jewellery via online platforms?

The omnichannel business model where the experience of the store is further connected online, enhanced retail sales for the engagement category by almost 50%. The retail engagement ring sales in 2020 grew from 14% online to 21%. The fashion category numbers are even more aggressive. These numbers in 2021 to 2023 will further grow as more retailers realize the importance of improving the consumer experience by using technology as well as shifting consumer behaviour. The key focus or the retail jewellery community is now to guardrail their consumers between the online and offline presence.

The report showed a significant increase in the production of lab-grown diamonds in 2019. What were production levels last year and where is the bulk of the production coming from?

The production of lab-grown diamonds from 2016 to 2021 has grown in multiple ways. Each year the production for all sizes doubled. What matters more is consumer acceptance and the speed at which that has happened. It has consistently beaten production speed and hence created a shortage for larger lab-grown diamonds.

The production for 2020 was around 6 million carats split between India and China. A larger number of the smaller diamonds come from China while the finer larger diamonds are coming from very limited producers in India.

Where is the innovation occurring in the lab-grown diamond sector? What has been the consumer experience in relation to premium branded lab-grown diamonds?

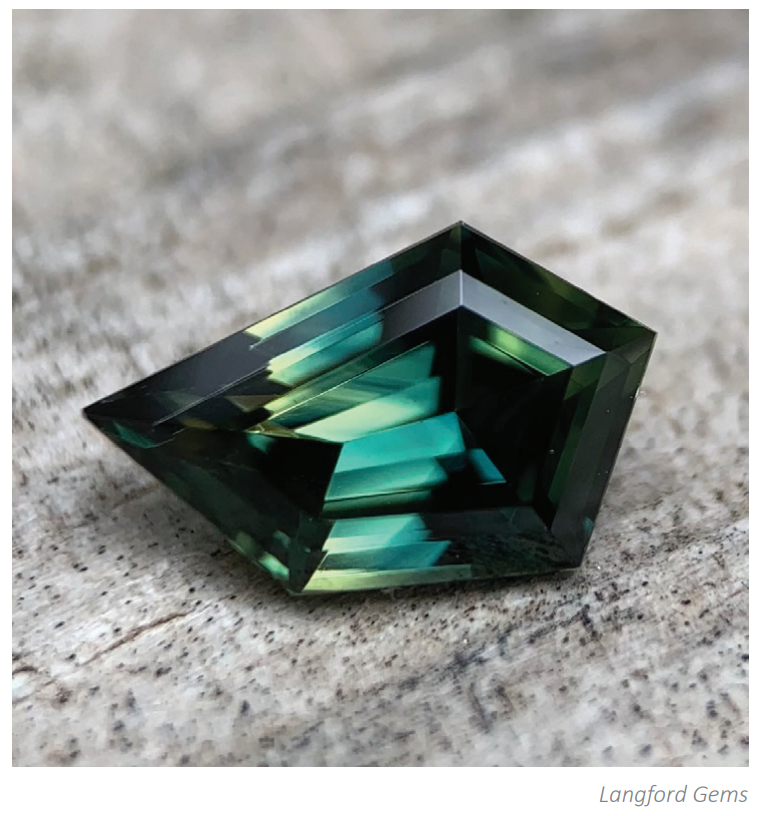

Technology is a constantly evolving world. Lab-grown diamonds have grown in size and quality in the last five years. Producers that have been focused on one carat are now focused between two and four carat production. Beautiful pinks, blues, canaries, and various coloured diamonds are going to be the norm in the next few years. While the production of lab-grown diamonds are growing in quality and quantity, one of the noticeable areas is the growth of the premium lab-grown diamond that the consumer is connecting with. Today’s consumer wants to know everything about the diamond from where it came from, the social and environmental impact of the components to make the jewellery, and finally the brand that is delivering the product with expedience. There is an emergence of premium brands that are starting to focus on these key consumer trends. I firmly believe that the lab grown category will further elevate the level of luxury that diamonds haven’t seen before.

An increased focus on environmental and sustainable practices today is impacting on diamond choices. Price and ethical concerns are driving sales in the lab-grown diamond sector. What are your projections for this category?

Authenticity and transparency are key to today’s consumer. While size plays a very strong role in the lab-grown diamond sales, the most important thing is the consumer confidence in the product. They are seeing the value along with authenticity and transparency that they have always asked for. Lab-grown diamonds also respond to today’s consumer who feels socially conscious and environmentally responsible. Sales of lab grown diamonds, in spite of the pandemic, exceeded my expectations. The growth of the category has been very clear and will double in sales as a wide range of consumers will have increased access. The lab-grown diamond jewellery category is still in its infancy and will explode in the next 18 months. The way I see it long term, is that a very wide group of consumers will now be able to access larger and more beautiful diamonds and will lead to the growth of the diamond category as a whole.

What marketing strategies for diamond jewellery proved effective during the pandemic? Are these likely to be adopted going forward?

Education is the key to consumer confidence. Retailers that used technology to communicate products and knowledge to the consumers have seen a higher closing ratio and increased spending. I believe this is the way of the future and will only be enhanced.

What are the long term structural changes that have been applied to the diamond industry as a result of the pandemic?

The most exciting part of the pandemic was forcing an archaic industry to understand the value of technology and experience to the consumer. It also explained to the diamond and jewellery industry the importance of brand marketing, education of products, compliance and being socially responsible. These changes are going to be permanent and the key to the growth of this industry.

How is price and aspiration influencing the diamond selections consumers are making today?

The consumer is exercising their right to choice, along with a synchronized pricing model between demand and supply for the first time in the diamond industry. The myth of rarity is broken, and consumers have begun asking questions about the education they have received. They are connecting with larger and beautiful lab-grown diamonds. This process of democratising luxury with improved economic scale in the manufacturing of lab-grown diamonds is going to provide the widest consumer space the diamond industry has ever seen. I’ve heard in the last decade that today’s women don’t want to wear large diamonds. Today I smile knowing that those women are wearing and aspiring for larger and more beautiful lab-grown diamonds. The trade forgot it’s not that they didn’t want larger diamonds, but rather that they were simply not accessible until now.

What are your projections for the diamond industry going forward?

The diamond industry overall is going to see very positive growth in the next five years. Innovation will be the key factor from product to process, from trading to platforms, and from stores to online. Every member of the industry that evolves and brings change that is required of their business will see growth in the next five years. The consumer behaviour has grown and will further evolve as every industry will work harder and harder for the dollar.