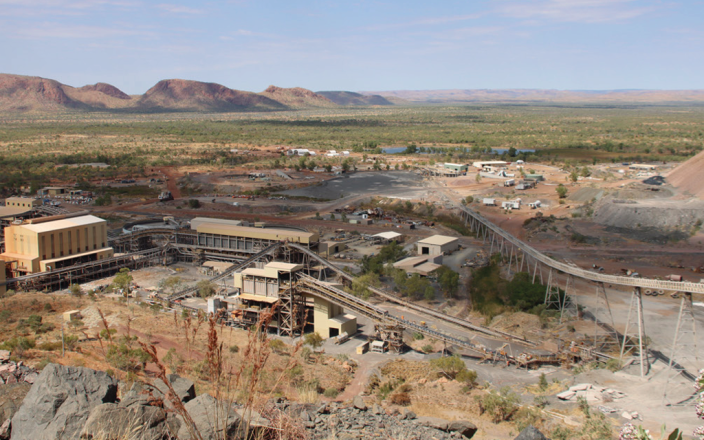

The pink diamond market continues to captivate collectors, investors, and connoisseurs worldwide, driven by increasing demand and the persistent scarcity of supply. Since the closure of Rio Tinto’s Argyle Mine in Western Australia in 2020—once responsible for over 90% of the world’s pink diamonds—these rare gemstones have soared in value, cementing their status as both a luxury and an investment asset.

Economic Trends: Exceptional Growth in Value

Industry data underscores the exceptional appreciation of pink diamonds in recent years. Reports indicate an average growth of 55% in their value since Argyle ceased operations, with experts predicting continued price increases as availability diminishes. According to the Fancy Color Research Foundation (FCRF), the Fancy Vivid Pink diamond category saw some of the steepest price hikes in 2023, reflecting their heightened desirability.

Michael King, Managing Director of Diamond Portfolio, highlights the scarcity premium: “With supply dwindling, pink diamonds are not just a luxury item; they are a finite resource.”

Insights for Ellendale Diamonds

Ellendale Diamonds Australia has been at the forefront of navigating the post-Argyle pink diamond market. Their commitment to quality and traceability sets them apart. “The closure of the Argyle Mine has made pink diamonds much rarer and, in turn, more desirable,” says a spokesperson for Ellendale. “We still access Argyle pink diamonds with chain-of-custody certification, making our offerings highly sought after by collectors and retailers.”

As new sources of pink diamonds become limited, Ellendale maintains high standards by comparing each diamond against a reference set of certified Argyle pink diamonds to ensure exceptional colour and clarity.

Auction Highlights: Record- Breaking Sales

Pink diamonds continue to shine in the auction market, achieving record-breaking prices. At Bonhams’ Hong Kong Jewels and Jadeite auction, a 30.1-carat round brilliant-cut pink diamond fetched $2.6 million, surpassing expectations. Sotheby’s and Christie’s have also showcased exceptional pink diamonds, further affirming their allure as investment pieces.

“Pink diamonds have become the ultimate statement piece for clients looking to combine beauty with investment potential,” remarks Brett O’Connor, Bonhams’ Head of Jewellery.

Investment Appeal: Beyond Luxury

For investors, pink diamonds remain a stable asset, likened to fine art or rare vintage watches. Ellendale Diamonds Australia notes that “the supply chain for pink diamonds has become more specialised, with fewer options available since Argyle’s closure.” This scarcity has solidified their position as an appreciating asset class, with demand expected to rise significantly over the next decade.

Ellendale also acknowledges the emergence of lab-grown alternatives but emphasises the unique appeal of natural Argyle-origin diamonds: “Lab-grown pink diamonds offer a lower-priced alternative, but they can’t replicate the rare hue of Argyle diamonds, preserving their exclusivity and value.”

A Focus on Legacy and Design

Leading jewellers continue to emphasise the rarity and beauty of pink diamonds in their creations. Ellendale shares, “We highlight the rarity of pink diamonds by making them the focal point in each piece. Simple, elegant settings draw attention to the diamond’s unique colour, often complemented by subtle rose gold accents.”

What’s next for the Pink Diamond Market?

As supply tightens, the pink diamond market is poised for further appreciation, particularly for stones with intense colour saturation. The industry’s commitment to provenance and ethical sourcing ensures that these gems remain a trusted choice for buyers.

For jewellers, pink diamonds are more than a product; they are a story of natural wonder, exclusivity, and enduring value. As Ellendale notes, “Pink diamonds are not just a gem—they are a piece of history, art, and investment.”